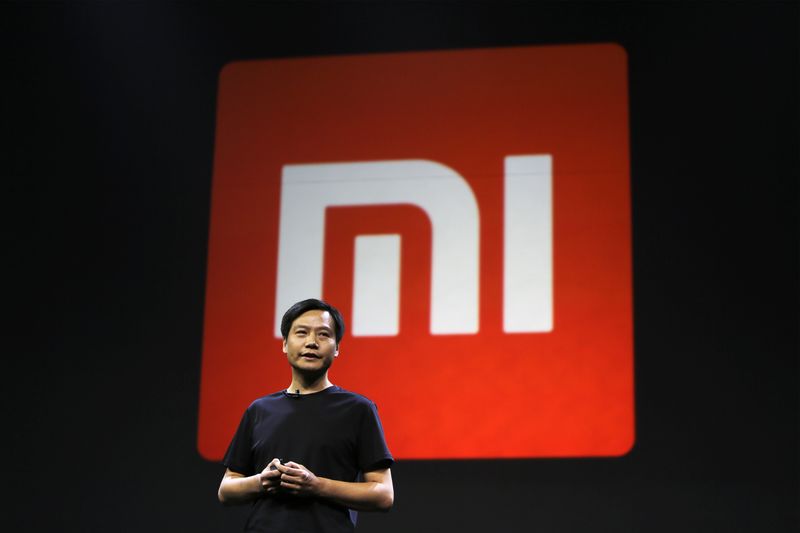

Xiaomi (OTC:XIACF), the Chinese multinational electronics company, announced on Wednesday, Nov 08, 2023, that it is introducing stringent restrictions on bootloader unlocking for its HyperOS-running phones, including the newly released Xiaomi 14 series and the forthcoming support for Xiaomi 13 and Xiaomi 12 devices. These measures are part of Xiaomi's commitment to enhance device security and data protection. The announcement was made during the global unveiling of the Xiaomi 14 series and HyperOS, a new operating system set to supersede MIUI.

The company's new policy mandates that bootloader unlocking on HyperOS smartphones will be disabled by default. To unlock their devices, users must apply through a Windows application or Xiaomi’s community forum and wait for a week before they can proceed with the unlocking process. This continues the company's tradition of requiring unlocking applications for security reasons.

For Chinese users, the policy is even more stringent. They must reach "level five" on the community forums before they can unlock their devices. Furthermore, time-sensitive rules limit unlocking to three times per year. Kacper Skrzypek from MIUI Polska explained these rules which are currently specific to the Chinese version of HyperOS but hold potential for expansion to international users.

A significant change in Xiaomi's policy is the termination of updates for devices with unlocked bootloaders, regardless of whether they operate on HyperOS or MIUI 14. This rule applies globally to all Xiaomi devices. Moreover, Xiaomi phones running on MIUI will not receive HyperOS upgrades - a feature in the new Xiaomi 14 phones - if their bootloaders are unlocked. However, MIUI users eligible for HyperOS updates won't be cut off entirely - they can access updates if they re-lock their devices using the Mi Flash Pro app. It should be noted that this re-locking process may lead to data deletion.

This stricter approach contrasts with other tech companies like OnePlus and Google (NASDAQ:GOOGL) Pixel, which allow direct bootloader unlocking without applications or waiting periods. The new policy has sparked concerns among tech enthusiasts and developers who rely on bootloader unlocking for exploring custom ROMs and unofficial updates.

While these new measures primarily aim at enhancing device security, they also strive to improve Xiaomi's software experience reputation. However, the impact of these changes on Xiaomi's global Android enthusiast and developer community remains uncertain. Anil Ganti from Android Authority reported that the global application of these rules is yet to be determined.

The most significant change from Xiaomi's 2016 policy is the termination of Android updates for devices with an unlocked bootloader, impacting all devices globally. This new context underscores the company's commitment to device security and data protection. Re-locking devices triggers immediate HyperOS updates, emphasizing the company's focus on keeping their devices updated for the users who comply with their security measures. This leads to a cycle of unlocking and relocking for users interested in receiving HyperOS or OTA updates under policies mirroring MIUI.

InvestingPro Insights

Xiaomi's recent policy changes have stirred up the tech community, but what do these changes mean for the company's financial position? Let's take a look at some real-time data and tips from InvestingPro.

InvestingPro Data indicates that Xiaomi has a healthy financial standing with a Market Cap of 145.8M USD and a P/E Ratio of 12.91 as of Q1 2024. The company's revenue for the last twelve months as of Q1 2024 stood at 609.48M USD, showing a modest growth of 3.09%.

As per InvestingPro Tips, Xiaomi holds more cash than debt on its balance sheet and is expected to see net income growth this year. Moreover, the company is a prominent player in the Technology Hardware, Storage & Peripherals industry and has seen a strong return over the last year. This is a good sign for potential investors, as it indicates the company's resilience and potential for growth.

In total, InvestingPro offers 14 additional tips for Xiaomi, providing a comprehensive guide for those interested in investing in the company. For more in-depth insights and tips, consider exploring InvestingPro's product offerings.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.