By Brenna Hughes Neghaiwi and Oliver Hirt

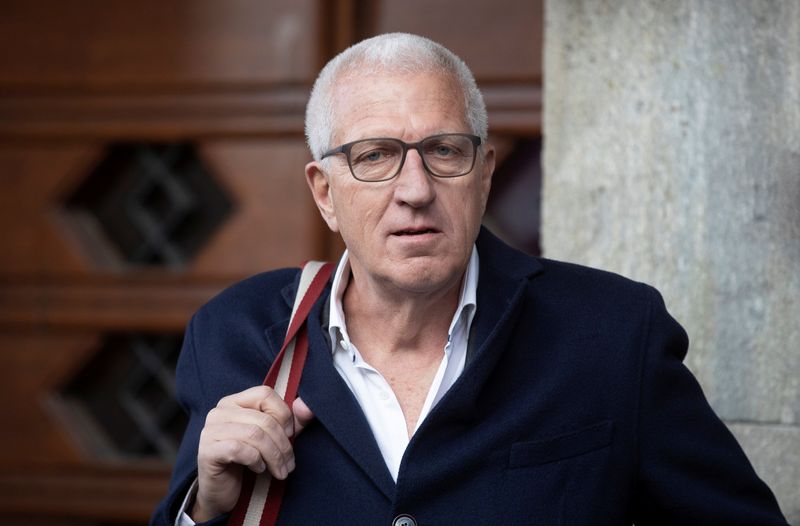

ZURICH (Reuters) -Former Raiffeisen Switzerland Chief Executive Pierin Vincenz was jailed for nearly four years on Wednesday at the end of a fraud trial which exposed his huge strip club bills and misuse of company expenses.

After one of Switzerland's highest-profile corporate crime trials in decades, Zurich's district court convicted Vincenz, a former Swiss 'banker of the year' who was charged with making millions through illicit deals while he was CEO of the bank.

Vincenz, who was acquitted on several counts, was fined 840,000 Swiss francs ($900,600) and ordered to pay nearly 1.6 million francs in damages to compensate firms in which he was involved, as the court also found the 65-year-old guilty of using business expenses for private purposes.

His lawyer told Reuters that Vincenz, who denies any wrongdoing, would appeal the verdict after he was sentenced to 3-3/4 years in prison.

Vincenz had told the court that a near 200,000 Swiss franc expenses bill for strip club visits was largely business-related, while a 700 franc dinner with a woman he met on dating app Tinder was justified because he was considering her for a real estate job.

But Judge Sebastian Aeppli told the court that the expense claims went too far and were not in his employer's interests.

"(His) understanding, whereby practically all expenditures of a business person fall under disposable company expenses so long as any remote connection to the business activity exists, clearly went too far," Aeppli said.

"The relationship maintenance he carried out in cabarets, strip clubs and contact bars was no longer in the primary interest of Raiffeisen," the judge said, adding prudent handling of Raiffeisen's money would have meant limiting tabs to 1,000 Swiss francs or less per occasion.

The trial, which was moved from a courthouse to Zurich's Volkshaus theatre due to the intense public interest, centred around conflicts of interest on deals between a number of firms in which Vincenz and another defendant were involved.

All seven defendants in the trial, which began in January, had denied the allegations against them.

Vincenz was ordered to pay Raiffeisen more than 260,000 Swiss francs over expenses he charged to the bank, while he was ordered to pay a further 1.3 million francs to compensate damages incurred by another firm over a corporate transaction.

Prosecutors had sought nearly 70 million Swiss francs in total in assets from the defendants, as well as pursuing financial penalties and prison sentences ranging from two to six years for all but one of them.

Prosecutor Marc Jean-Richard-dit-Bressel told reporters that his office would await the written verdict as well as other parties' next moves before deciding on any possible appeal, but noted the court had largely supported the prosecutors' charges.

($1 = 0.9327 Swiss francs)