By Andrea Shalal and David Lawder

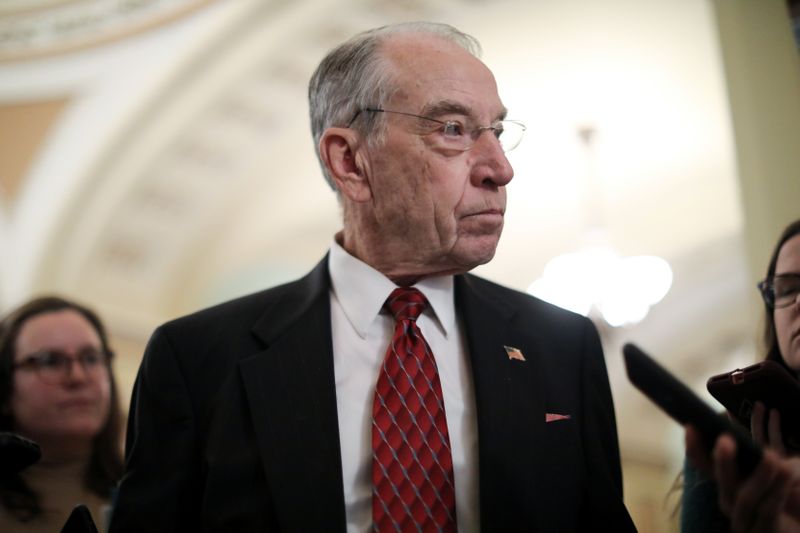

WASHINGTON (Reuters) - Washington needs to give China some leeway in implementing a Phase 1 trade deal given a downturn in the world's second largest economy caused by the coronavirus, U.S. Senate Finance Committee Chairman Chuck Grassley said on Wednesday.

Grassley told Reuters in an interview that he saw no evidence that China intended to try to escape its commitments under the deal to sharply increase its purchases of U.S. farm goods, manufactured products, energy and services.

But the coronavirus could require some adjustments and would likely delay the start of negotiations on a Phase 2 trade agreement, the Iowa Republican said.

China's moves to reduce some tariffs on U.S. goods and allow U.S. inspections of their food showed they were acting in "good faith," Grassley added.

"We have to give some leeway to them because of the downturn in their economy, and less consumption as a result of it," he told Reuters.

Even before the outbreak, experts had questioned China's ability to buy $200 billion more in U.S. goods and services over the next two years. They said the epidemic, which led to widespread work stoppages across China, will make it extremely difficult for Beijing to hit its purchase targets this year.

The International Monetary Fund on Wednesday said the outbreak had slowed in China and Chinese officials expected to restore production capacity to around 90% soon. But it said China's economic growth was still expected to fall short of the IMF's recent forecast of 5.6% in 2020.

A Washington-based Chinese official last week said Beijing was serious about implementing the trade deal, but a halt in air traffic and a travel ban on Chinese people entering the United States would complicate meeting the targets.

U.S. Agriculture Secretary Sonny Perdue on Wednesday predicted China will come into the U.S. market for soybeans in late spring and summer.

Grassley said the Federal Reserve Board's interest rate cut could help offset negative impacts from the virus, adding that cuts to U.S. tariffs on China would be a way for the U.S. government to stimulate the economy if needed.

"If they needed to do something, they'd get the tariffs done a lot faster than they'd get a tax cut through Congress," he said. "Right now, with what the Federal Reserve has done, we'll just feel our way along."