By David Shepardson

WASHINGTON (Reuters) -The U.S. Department of Commerce said Thursday it will launch a survey of the U.S. semiconductor supply chain and national defense industrial base to address national security concerns from Chinese-sourced chips.

The survey aims to identify how U.S. companies are sourcing so-called legacy chips - current-generation and mature-node semiconductors - as the department moves to award nearly $40 billion in subsidies for semiconductor chips manufacturing.

The department said the survey, which will begin in January, aims to "reduce national security risks posed by" China and will focus on the use and sourcing of Chinese-manufactured legacy chips in the supply chains of critical U.S. industries.

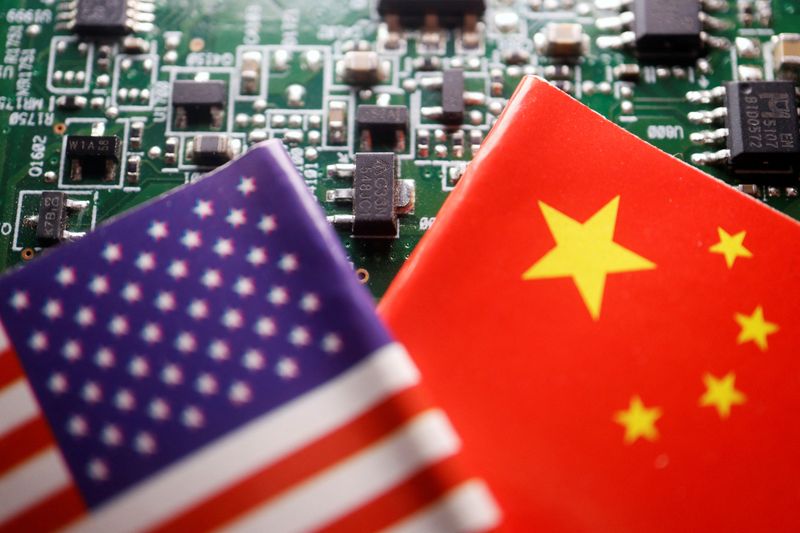

A report released by the department on Thursday said China has provided the Chinese semiconductor industry with an estimated $150 billion in subsidies in the last decade, creating "an unlevel global playing field for US and other foreign

competitors."

Commerce Secretary Gina Raimondo said "over the last few years, we've seen potential signs of concerning practices from (China) to expand their firms' legacy chip production and make it harder for U.S. companies to compete."

China's embassy in Washington said Thursday the United States "has been stretching the concept of national security, abusing export control measures, engaging in discriminatory and unfair treatment against enterprises of other countries, and politicizing and weaponizing economic and sci-tech issues."

Raimondo said last week she expects her department to make around a dozen semiconductor chips funding awards within the next year, including multi-billion dollar announcements that could drastically reshape U.S. chip production. Her department made the first award from the program on Dec. 11.

The Commerce Department said the survey will also help promote a level playing field for legacy chip production. "Addressing non-market actions by foreign governments that threaten the U.S. legacy chip supply chain is a matter of national security," Raimondo added.

U.S.-headquartered companies account for approximately half of global semiconductor revenue but face intense competition supported by foreign subsidies, the department said.

Its report said the cost of manufacturing semiconductors in the United States may be "30-45% higher than the rest of the world" and it called for long-term support for domestic fabrication construction.

It added that the U.S. should enact "permanent provisions that incentivize steady construction and modernization of semiconductor fabrication facilities, such as the investment tax credit scheduled to end in 2027."