By David Morgan

WASHINGTON (Reuters) -The Republican-controlled U.S. House voted on Tuesday to block President Joe Biden's administration from allowing retirement plans to consider environmental, social and corporate governance, or ESG, issues in their investment decisions.

The lawmakers voted 216-204 to adopt a joint resolution that would prevent the Labor Department from enforcing a rule that makes it easier for plan managers to consider ESG factors when they make investments and exercise shareholder rights, such as through proxy voting.

The action, the latest salvo in a Republican culture war against "woke" business practices, sends the measure onto the Senate, where Republicans hope to muster enough support to pass it as early as Wednesday.

If approved by both chambers, the resolution would go to Biden, a Democrat, who the White House said would veto it.

Republicans claim the Labor rule represents a Biden administration ploy to politicize investing by allowing plan managers to pursue liberal causes with the retirement savings of unwitting investors.

Representative Andy Barr, who introduced the House measure, warned that the Labor rule would ultimately saddle Americans with higher fees for less-diversified investments in lower-performing portfolios. "Twenty-one percent of investors don't even know what ESG stands for," Barr said.

The regulation, which took effect in January, covers plans that collectively invest $12 trillion on behalf of more than 150 million people.

Experts said the Biden administration has made only cosmetic changes to an earlier regulation adopted under former President Donald Trump. Where the Trump rule required plan managers to "prudently" determine whether a factor would have a "material" effect on investments, the Biden rule says they can "reasonably" determine "relevant" effects, according to an analysis published by Harvard Law School.

Both the Trump and Biden rules prohibit plan managers from subordinating the financial interests of beneficiaries to other objectives.

But the political battle over ESG issues is likely to intensify as the 2024 presidential campaign gets under way. Florida Governor Ron DeSantis, widely seen as a leading White House contender, has already made his own fight against "woke" businesses a hallmark of his image.

The House vote could be followed by action in the Senate, where Democrats have a 51-49 majority. Republicans have support from all 49 of their members and Democratic Senator Joe Manchin. But they could need an additional Democrat or one of the three independents who normally vote with the Democrats to pass the measure on a simple majority.

"I'll be proud to support this commonsense measure later this week," Senate Republican leader Mitch McConnell said in a floor speech.

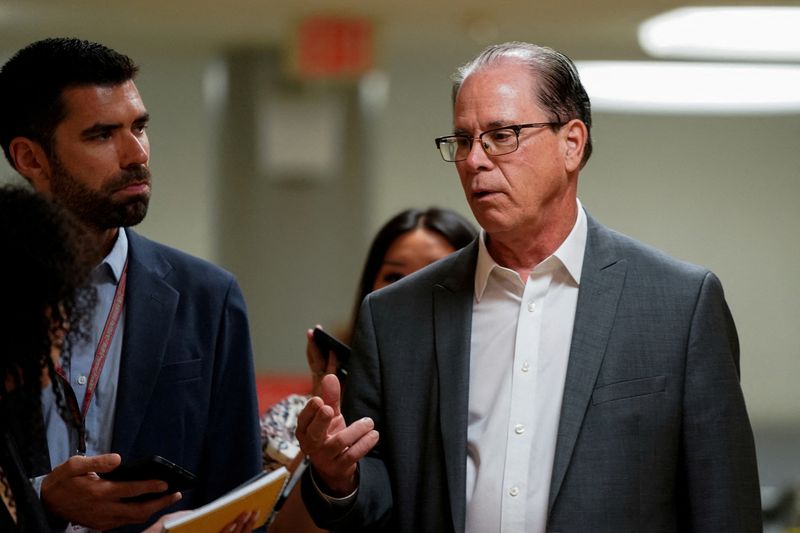

Republican Senator Mike Braun is bringing the resolution under the Congressional Review Act, which bypasses the Senate's "filibuster" rule that requires the support of 60 senators to pass most legislation.

The White House on Monday said that Biden would veto the bill if it reached his desk.

"The rule reflects what successful marketplace investors already know – there is an extensive body of evidence that environmental, social and governance factors can have material impacts on certain markets, industries and companies," it said in a statement.

Last week, 25 Republican-led states asked a federal judge in Texas to block the same rule, warning that the regulation could lead to millions of Americans losing retirement investments and harm state finances. Plaintiffs in the case include an oil drilling company and an oil and gas trade group.