By Joyce Lee and Ben Blanchard

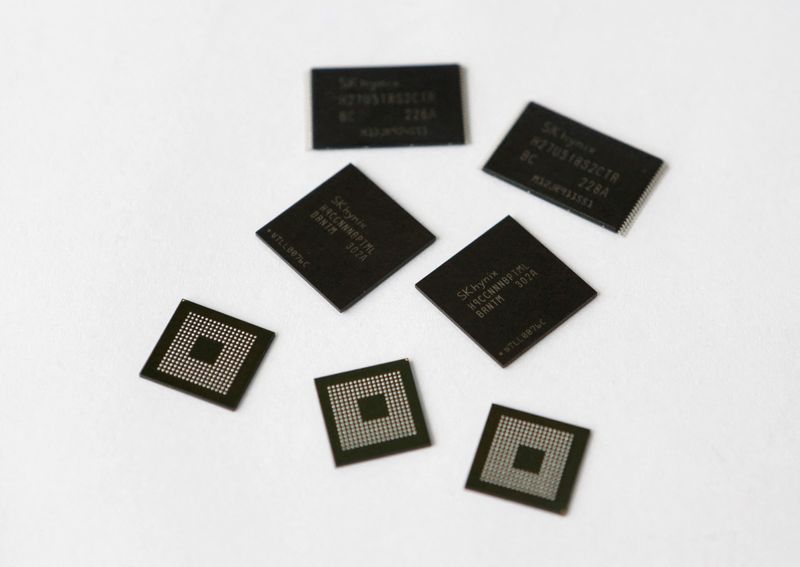

SEOUL/TAIPEI (Reuters) - The criteria for new U.S. semiconductor subsidies is worrying companies such as Samsung Electronics (OTC:SSNLF) Co Ltd and SK Hynix Inc, South Korean President Yoon Suk Yeol said on Thursday, a concern shared by the world's leading contract chipmaker in Taiwan.

Conditions include sharing excess profit with the U.S. government, and three industry sources said the application process itself could expose confidential corporate strategy.

Yoon met with United States Trade Representative Katherine Tai in Seoul, and asked the U.S. government to consider companies' concern over an "excessive level of information provision", the presidential office said.

Subsidies would come from a $52 billion pool of research and manufacturing funds earmarked under the United States' so-called CHIPS Act, for which the Commerce Department announced guides and templates this month.

SK Hynix parent SK Group plans to invest $15 billion in the U.S. chip sector, including to build an advanced chip packaging factory, and has said it is considering applying for funding. Samsung (KS:005930) is building a chip plant in Texas that could cost more than $25 billion and has said it is reviewing the guidelines.

However, funding applications may require detailed cost structure information as well as projected wafer yields, utilisation rates and price changes, which three Korean chip sources told Reuters was akin to revealing corporate strategy.

"All of this is confidential information. The most important thing in chips is cost structure. Experts will be able to tell our strategy at a glance," said one of the sources, who declined to be identified due to the sensitivity of the matter.

Speaking at an industry event in Taiwan, the chairman of Taiwan Semiconductor Manufacturing Co Ltd (TSMC), the world's largest contract chipmaker, said it had concerns too.

"We are still discussing with them. There are some conditions that cannot be accepted. We hope that they can be adjusted so there will be no negative effect. We will continue to talk to the U.S. government," Mark Liu told reporters.

TSMC is investing $40 billion in a new plant in Arizona.

The U.S. Department of Commerce will protect confidential business information and expects that the requirement to share excess profit will only occur where projects significantly exceed projected cash flow, a Department of Commerce official said, citing its notice for the funding.

It will accept subsidy applications for leading-edge chip facilities from March 31, and for current-generation, mature-node and back-end production facilities from June 26.

Also on Thursday, South Korea's parliament approved a bill offering large tax breaks to strategic industries - including the semiconductor industry - which invest at home, to strengthen supply-chain security while boosting the economy.

The approval comes in the same month the government announced a 550 trillion won ($424 billion) private-sector investment plan to maintain the competitiveness of high-tech industries while other countries are actively bolstering theirs.

($1 = 1,297.8800 won)