By Joseph Ax

NEW YORK (Reuters) - The union leader for New York City's prison guards and a hedge fund financier were charged on Wednesday with orchestrating a bribery scheme involving union retirement and operating funds in a case stemming from a sprawling federal corruption probe.

The Federal Bureau of Investigation arrested Norman Seabrook, the politically influential president of the Correction Officers' Benevolent Association, and Murray Huberfeld early on Wednesday.

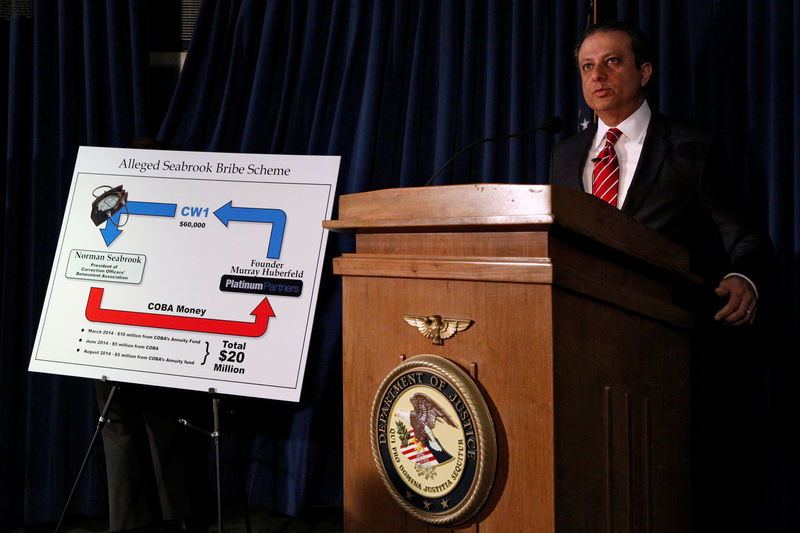

According to a criminal complaint, Seabrook invested $20 million of union money in 2014 in New York-based Platinum Partners in exchange for kickbacks from Huberfeld, who worked at the firm. The men were charged with honest services fraud and conspiracy to commit fraud.

The case is the first major prosecution to emerge from several overlapping state and federal corruption probes that are examining New York City Mayor Bill de Blasio's fundraising practices, among other avenues of inquiry.

The unfolding scandal has proven to be a major distraction for de Blasio, who will be up for re-election in 2017 and has seen numerous press conferences hijacked by questions about the investigations in recent months.

De Blasio has repeatedly said he and his administration acted legally at all times.

In April, Reuters was first to report that Seabrook had invested union funds in Platinum, a mid-sized firm with a history of buying into controversial businesses, including two energy companies that are facing criminal charges.

Representatives for Platinum Partners did not respond to a request for comment. Lawyers for Seabrook and Huberfeld could not immediately be reached for comment.

The criminal complaint refers to a "cooperating witness" who has pleaded guilty and is helping the government. The witness initially referred Seabrook to Huberfeld and Platinum and helped arrange the bribery scheme, according to prosecutors.

A person familiar with the matter previously told Reuters that Jona Rechnitz, a New York real estate investor, introduced Seabrook to Platinum.

ONGOING PROBE

Rechnitz, who has contributed more than $150,000 to efforts supported by the mayor, is at the heart of an ongoing probe looking into de Blasio's fundraising activities as well as police corruption.

Investigators have focused on Rechnitz and another businessman, Jeremy Reichberg, and whether they gave police officers gifts and trips in exchange for official favors. Several high-ranking officers have been reassigned or disciplined as a result of the probe.

Rechnitz and Reichberg had ties to de Blasio when he ran successfully for mayor in 2013, serving on his inaugural committee.

The complaint indicated that Rechnitz, who is described only as a "cooperating witness," is continuing to provide information to government investigators in the hopes of securing a reduced sentence.

Rechnitz's lawyer, Alan Levine, declined to comment on Wednesday.

'RUNNING OUT OF ADJECTIVES'

The case is the latest in a string of high-profile public corruption cases brought by the office of Preet Bharara, the U.S. Attorney in Manhattan, who last year secured the convictions of the legislative leaders of the state Assembly and Senate.

"I'm running out of adjectives to describe it," he told reporters on Wednesday.

The unnamed cooperating witness, whose description matches that of Rechnitz, first met Seabrook through a police officer in 2013. He also knew Huberfeld, who had an office at Platinum, the complaint said.

According to the witness, Huberfeld was secretly running Platinum, but his role was not publicly acknowledged because of "a prior lawsuit or investigation relating to a fund Huberfeld previously ran," the complaint said. Platinum founder Mark Nordlicht could not be reached for comment on Wednesday.

Huberfeld was ordered to disgorge profits and fined for violating securities laws at his Broad Capital fund. He later provided Platinum with start-up money and ran Nordlicht's credit-focused hedge funds until Platinum took them over in 2011.

In 2013, the witness, Seabrook, a police officer and others took two trips to the Dominican Republic. There, Seabrook complained that he worked hard to invest the union's money but made none for himself, according to the criminal complaint.

It was time "Norman Seabrook got paid," he told the witness, according to the complaint.

Authorities said the witness helped orchestrate a fraud scheme in which Huberfeld promised to return half of Platinum's 20 percent commission to Seabrook as a kickback.

The witness agreed to use his own money to bribe Seabrook and at Huberfeld's suggestion created a fake invoice for New York Knicks tickets he supposedly sold to Platinum in order to get reimbursed, the complaint said.

He then brought $60,000 in cash to Seabrook on Dec. 11, 2014, in a new $820 Salvatore Ferragamo bag he had purchased just for the handoff, according to court documents.