By Kirstin Ridley

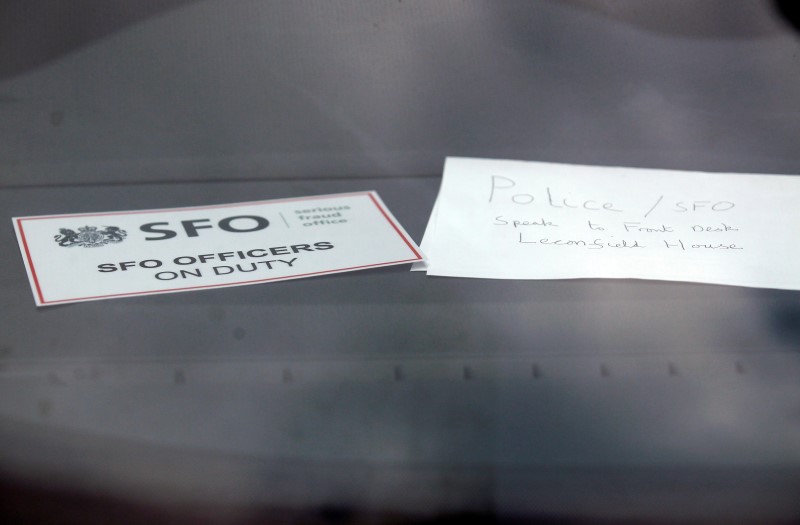

LONDON (Reuters) - Britain's Serious Fraud Office (SFO) faces a fresh challenge on Friday when it is expected to try to bring four Germans and a Frenchman to London to face rate-fixing charges, a source familiar with the matter said.

Long-standing questions about the ability of the SFO to successfully investigate, prosecute and manage through trial top-drawer fraud and corruption cases have resurfaced after six former brokers charged with colluding with convicted rate-fixer Tom Hayes were promptly acquitted by a jury in January.

Then on Tuesday, the SFO unexpectedly dropped an inquiry into allegations of rigging in the $5.3 trillion per day foreign exchange market.

The conviction of former UBS (S:UBSG) and Citigroup (N:C) trader Hayes in August for conspiracy to rig Libor benchmark interest rates was seen as a high point in the SFO's recent history and a vindication for its head David Green.

But the decision to drop the forex inquiry has led some to question whether the agency is now willing to risk failure.

"It suggests that the SFO is losing its appetite for risk and that the Hayes verdict may be the high water mark for these prosecutions," says Ben Rose, of law firm Hickman & Rose.

This view was echoed by Sara Teasdale, partner at law firm Byrne and Partners: "(The forex) announcement begs the question as to whether the SFO remains 'fit for purpose'."

The SFO dismissed the suggestion.

"These kinds of cases are precisely those the SFO was established to investigate, and we will not hesitate to continue with them where the evidence justifies it," an SFO spokeswoman said.

EURIBOR TEST

The SFO has said it will tell Southwark Crown Court on Friday whether it will seek an arrest warrant as a precursor to extradition proceedings after former Deutsche Bank (DE:DBKGn) colleagues Kai-Uwe Kappauf, Joerg Vogt, Andreas Hauschild, Ardalan Gharagozlou and former Societe Generale (PA:SOGN) trader Stephane Esper declined to attend a UK court in January.

Their decision not to attend to be charged with "conspiracy to defraud" complicated SFO plans to prosecute 10 men and one woman for an alleged plot to rig Euribor (euro interbank offered rate) which, like Libor, is a benchmark for rates on trillions of financial products and loans globally.

Lawyers for Hauschild and Vogt declined to comment. Legal representatives for the other three did not respond to requests for comment.

Friday's "Euribor Five" hearing will put the SFO back under scrutiny just before its next major trial begins on April 4, when a group of former Barclays (L:BARC) traders, charged with conspiracy to manipulate Libor rates, will face a London jury.

If the Euribor five challenge and lose an extradition battle, they risk being refused bail and preparing for trial in custody with limited access to legal advice, lawyers say.

However, parallel local inquiries into alleged rate-rigging outside the UK could complicate extradition attempts, as could Germany's time bar on when legal action must be launched.

The SFO's planned charge of "conspiracy to defraud" is also unusual internationally and could become a focus of argument, some lawyers say. In its last two Libor trials, the SFO did not need to produce victims or quantify losses, which can be unusual for fraud cases.

The first Euribor trial has been set for 2017 and those already charged with conspiracy to rig the rate include Singapore-based Frenchman Christian Bittar, a former star Deutsche Bank trader whose bail was set at 1.0 million pounds ($1.4 million).

Other defendants include Singapore-based Philippe Moryoussef, who once worked for Barclays, and former colleagues Colin Bermingham, Sisse Bohart and Carlo Palombo as well as Deutsche Bank trader Achim Kraemer.

Lawyers for Kraemer, Palombo and Bittar have said previously their clients denied the allegations. Others did not immediately respond to requests for comment.