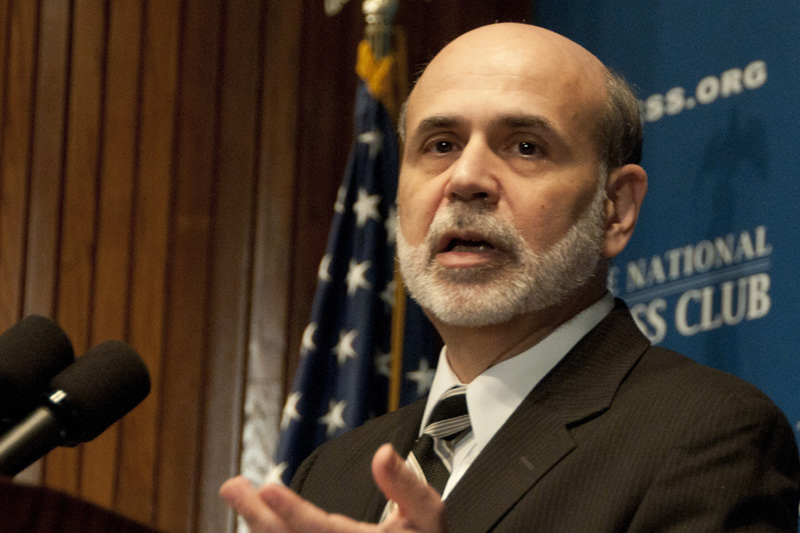

Investing.com - U.S. stock futures pointed to a broadly higher open on Thursday, after the Federal Reserve gave no indications on whether it will begin to taper its bond buying program in the near future.

Stronger-than-expected data on manufacturing activity out of the euro zone and China further supported gains.

Ahead of the open, the Dow Jones Industrial Average futures pointed to a gain of 0.7% at the open, S&P 500 futures indicated an increase of 0.7%, while the Nasdaq 100 futures pointed to a 0.7% rise.

At the conclusion of its two-day policy meeting on Wednesday, the Fed said it would keep buying USD85 billion a month in mortgage and Treasury securities and added that the pace of economic growth is "modest".

In earnings news, Time Warner Cable shares could be active after the company reported second quarter earnings per shares of USD1.69, above market expectations for USD1.65.

Revenue during the period totaled USD5.55 billion, below forecasts of USD5.57 billion.

Other stocks likely to be in focus included Dow components Exxon Mobil and Procter & Gamble, both scheduled to post results ahead of the opening bell.

Later in the day, the U.S. was to publish official data on weekly unemployment claims, followed by a report by the Institute of Supply Management on manufacturing activity.

Market players also looked ahead to highly-anticipated data on U.S. nonfarm payrolls due on Friday for indications of how the recovery in the U.S. labor market is progressing.

Across the Atlantic, European stock markets were higher, after data indicated that the slump in the euro zone’s manufacturing sector is easing.

The EURO STOXX 50 rose 0.7%, France’s CAC 40 added 0.4%, Germany's DAX edged rallied 1.1%, while Britain's FTSE 100 gained 0.3%.

Data released earlier showed that July’s manufacturing purchasing managers’ index improved to a two-year high of 50.3 from 48.8 in June.

Germany’s manufacturing PMI was revised up to an 18-month high of 50.7 in July from a final reading of 48.6 in June and above the preliminary reading of 50.3.

Elsewhere in Europe, the U.K. manufacturing PMI rose to 54.6 in July, the fastest rate of growth in 28 months.

Market players now looked ahead to policy decisions from the Bank of England and the European Central Bank later in the session.

During the Asian trading session, Hong Kong's Hang Seng Index rose 0.95%, while Japan’s Nikkei 225 Index surged 2.5% on the back of a slew of upbeat earnings reports.

Sentiment was also buoyed following the release of stronger-than-expected data on Chinese factory activity.

A government report released earlier in the session showed that China’s manufacturing purchasing managers' index rose unexpectedly to 50.3 in July from 50.1 in June.

A reading above 50.0 indicates industry expansion, below indicates contraction.

Stronger-than-expected data on manufacturing activity out of the euro zone and China further supported gains.

Ahead of the open, the Dow Jones Industrial Average futures pointed to a gain of 0.7% at the open, S&P 500 futures indicated an increase of 0.7%, while the Nasdaq 100 futures pointed to a 0.7% rise.

At the conclusion of its two-day policy meeting on Wednesday, the Fed said it would keep buying USD85 billion a month in mortgage and Treasury securities and added that the pace of economic growth is "modest".

In earnings news, Time Warner Cable shares could be active after the company reported second quarter earnings per shares of USD1.69, above market expectations for USD1.65.

Revenue during the period totaled USD5.55 billion, below forecasts of USD5.57 billion.

Other stocks likely to be in focus included Dow components Exxon Mobil and Procter & Gamble, both scheduled to post results ahead of the opening bell.

Later in the day, the U.S. was to publish official data on weekly unemployment claims, followed by a report by the Institute of Supply Management on manufacturing activity.

Market players also looked ahead to highly-anticipated data on U.S. nonfarm payrolls due on Friday for indications of how the recovery in the U.S. labor market is progressing.

Across the Atlantic, European stock markets were higher, after data indicated that the slump in the euro zone’s manufacturing sector is easing.

The EURO STOXX 50 rose 0.7%, France’s CAC 40 added 0.4%, Germany's DAX edged rallied 1.1%, while Britain's FTSE 100 gained 0.3%.

Data released earlier showed that July’s manufacturing purchasing managers’ index improved to a two-year high of 50.3 from 48.8 in June.

Germany’s manufacturing PMI was revised up to an 18-month high of 50.7 in July from a final reading of 48.6 in June and above the preliminary reading of 50.3.

Elsewhere in Europe, the U.K. manufacturing PMI rose to 54.6 in July, the fastest rate of growth in 28 months.

Market players now looked ahead to policy decisions from the Bank of England and the European Central Bank later in the session.

During the Asian trading session, Hong Kong's Hang Seng Index rose 0.95%, while Japan’s Nikkei 225 Index surged 2.5% on the back of a slew of upbeat earnings reports.

Sentiment was also buoyed following the release of stronger-than-expected data on Chinese factory activity.

A government report released earlier in the session showed that China’s manufacturing purchasing managers' index rose unexpectedly to 50.3 in July from 50.1 in June.

A reading above 50.0 indicates industry expansion, below indicates contraction.