(Bloomberg) --

Turkish stocks slumped, closing in a bear market, as the country struggles with the aftermath of two devastating earthquakes, with a three-month state of emergency declared for affected areas.

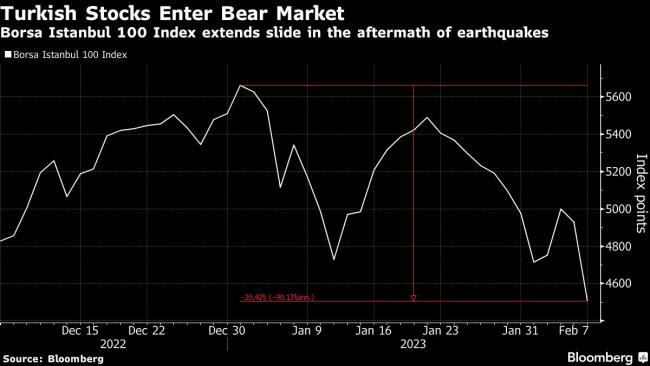

The benchmark Borsa Istanbul 100 Index tumbled 8.6% on Tuesday in a broad-based selloff, with Turkish Airlines (IS:THYAO) and the refiner Turkiye Petrol Rafinerileri AS (IS:TUPRS) weighing on the gauge. The index, which is the worst-performing major equity market in the world this year, has now dropped more than 20% from its peak on Jan. 2 — making it a technical bear market.

Automatic market-wide circuit-breakers were triggered earlier in the day, when the market’s decline crossed the 5% and 7% thresholds. Tuesday’s drop was the biggest slide since March 2021.

Ten Turkish cities, along with parts of neighboring Syria, were struck by two massive earthquakes on Monday. The death toll in the two countries has already topped 5,000, with emergency teams racing against time to rescue potentially thousands of victims trapped in the rubble.

Quake Latest: Turkey Declares Three-Month State of Emergency

Turkey’s Capital Markets Board rolled back some of the precautionary measures it took on Monday in order to limit the fallout for the stock market. It removed a temporary deposit rule, which requires traders to have stocks ready in their brokerage account in order to execute trades. That may have exacerbated the move today.

A ban on short selling — or betting against Turkish stocks — remained in place.

“The uncertainty regarding the burden of the earthquake and fear environment are exacerbating the losses,” said Tuna Cetinkaya, assistant general manager at the Info Yatirim brokerage. “That said, it’s important to keep the stock market running in order to respond to cash needs of investors from the regions impacted by the earthquakes,” he said.

Memories of 1999, when tremors months apart hit Turkey’s industrial hub near Istanbul, may also be fueling panic among retail traders. Trading in Turkish stocks was suspended for a week after that event — leading to talks among market players this time around on whether it would be more appropriate to do the same.

“The rationale behind it being kept open this time is to keep cash flowing in the market. However this is meaningless unless the central bank provides unlimited liquidity at 9%,” said Gokhan Uskuay, a fund manager at Albatross Portfoy, referring to Turkey’s benchmark interest rate.

“There is demand for the lira without lira liquidity in the market. So people sell stocks to create liquidity. Without CBRT funding, the sell off will likely continue,” Uskuay said.

©2023 Bloomberg L.P.