(Bloomberg) -- The Turkish government will unveil measures to help banks tackle the expected pile-up of bad loans resulting from the lira’s plunge and soaring interest rates, according to people with knowledge of the matter.

The plan will seek to mitigate the need for capital injections and propose carving out non-performing loans for transfer to a state-designated entity, said the people, who asked not to be named because the deliberations are confidential. The plan is likely to be announced Thursday, one of the people said.

Shares of Turkish banks rallied on the news. Even before the currency crisis worsened in August, Turkey’s lenders were struggling to deal with a pile-up of restructurings. The lira has dropped about 40 percent against the dollar this year, matching the Argentine peso as the world’s worst-performing currency and hurting Turkish firms’ ability to repay foreign-currency loans.

The measures were discussed in a series of meetings between bank executives and senior government officials last week, according to one of the people. On Thursday, Treasury and Finance Minister Berat Albayrak is expected to announce a medium-term economic program with fiscal and macroeconomic targets for the next three years, and the help for banks will likely be unveiled then, the person said.

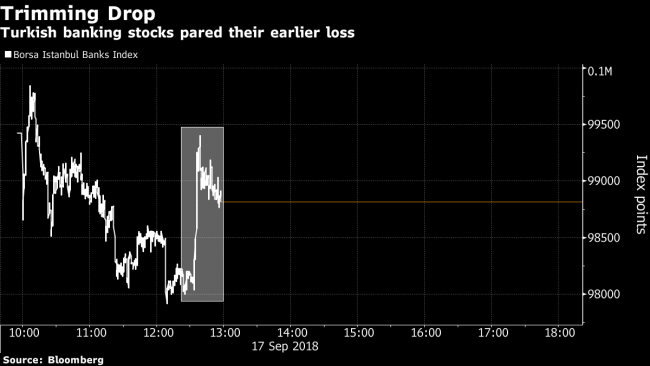

The Borsa Istanbul Banks Index pared its loss from as much as 2.6 percent to a 1.7 percent decline as of 1:15 p.m. in Istanbul.

The Treasury and Finance Ministry didn’t immediately comment on the plan when reached by Bloomberg.

The lira’s losses in August were triggered by U.S. sanctions on two Turkish ministers over the detention of an American pastor, and they accelerated when U.S. President Donald Trump imposed tariffs on some of the nation’s imports. That exacerbated existing concern about President Recep Tayyip Erdogan’s unconventional economic views and opposition to interest-rate increases.

Last week, the central bank defied Erdogan, jacking up rates to 24 percent, more than expected, though the currency is still trading below where it was in July.

(Adds bank share move, chart from third paragraph.)