(Bloomberg) -- Trump administration efforts to protect U.S. aluminum producers from Chinese overproduction apparently haven’t done anything to help save two Alcoa (NYSE:AA) Corp. plants in Spain.

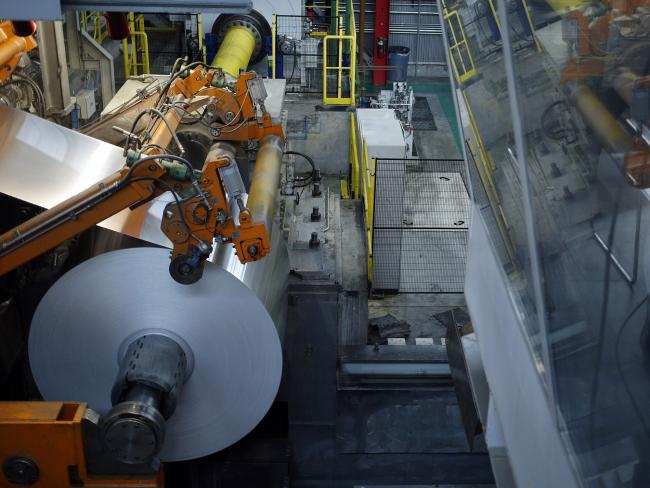

The excess supplies from China that aren’t able to get into the U.S. make their way into other countries including Spain. After struggling to compete against cheaper Chinese aluminum, Alcoa said it’s shutting its “least productive” smelters, Aviles and La Coruna, which employ 686 workers and account for 6 percent of the Pittsburgh-based company’s total capacity. The Spanish government said the announcement took it by surprise.

The issues facing American aluminum producers, however, are decades in the making. The U.S. aluminum industry has repeatedly cited China’s overcapacity as the biggest culprit threatening the global industry. Despite the wide-ranging call to address China’s overproduction, the Trump administration applied 10 percent tariffs on imports from most countries, including key trade allies like Canada and the European Union.

Alcoa, which generated more than half its revenue outside the U.S. last year, has publicly said it doesn’t support the administration’s tariff decisions, and continues to say that Chinese overcapacity must be addressed. The company said rising raw-material and energy costs also contributed to losses from its Spanish operations.

(Updates to add details on excess Chinese supplies in second paragraph.)