By David Shepardson

WASHINGTON (Reuters) - The White House budget released on Monday proposed cutting funding for the U.S. government-owned passenger rail carrier Amtrak while calling for a significant hike in infrastructure spending and killing a clean energy auto loan program.

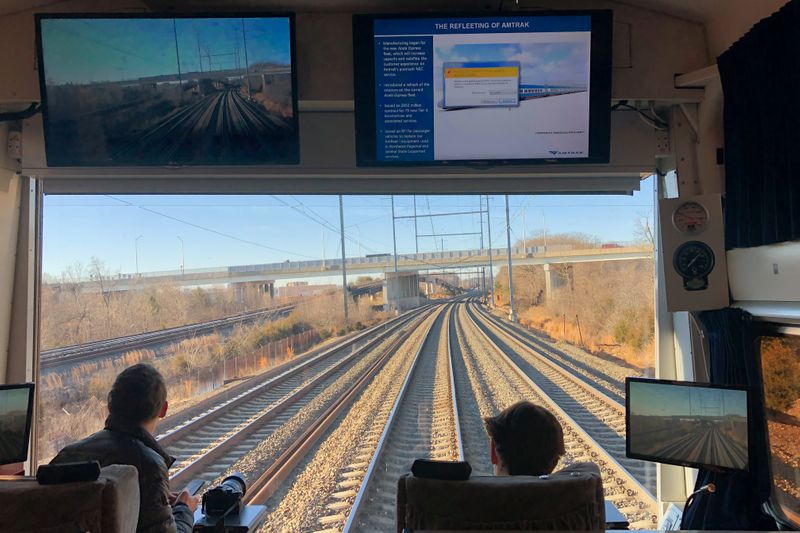

The proposal would cut Amtrak funds in fiscal 2021 by more than 50% over 2020 levels. It could cut funds to the congested northeast corridor from $700 million to $325 million and cut long-distance train funds from $1.3 billion to $611 million, then phase out support for Amtrak's long-distance trains.

Democrats are not likely to go along with the proposal, which is similar to cuts that have been rebuffed in prior budgets proposed by the administration of President Donald Trump.

Trump has also sparred with Democratic lawmakers over a $13 billion infrastructure project to build and repair tunnels and bridges in the New York City area known as "Gateway" that is critical to Amtrak ridership in the northeast.

In November, Amtrak said it had set records for ridership, revenue, and financial performance for the year ended Sept. 30, 2019, including 32.5 million customer trips, a year-over-year increase of 800,000 passengers.

Amtrak reported a loss of $29.8 million in the year compared with a loss of $170.6 million in the prior fiscal year.

The Trump budget calls for $810 billion in highway, transit, safety and other surface transportation funds and an additional $190 billion for other projects. It does not specify how to pay for the repairs or for funding the projected $261 billion shortfall in the highway trust fund over the next 10 years.

Joel Szabat, a deputy assistant secretary at the Department of Transportation, told reporters on a call the administration was "committed to working with Congress on a bipartisan basis to find a responsible way of funding" the shortfall.

Monday's budget again also calls for eliminating an Energy Department clean vehicle loan program that boosted Tesla (NASDAQ:TSLA) Inc, Nissan Motor Co and Ford Motor (NYSE:F) Co during the last industry downturn, but has not funded a new project in almost a decade.

Start-up Lordstown Motors Chief Executive Steve Burns told Reuters last month the company wanted to apply for a $200 million loan from the program to retool a former General Motors (NYSE:GM) factory in Lordstown, Ohio.

Burns met with Energy Secretary Dan Brouillette for an hour to discuss the proposal last month. Lordstown, which is partially owned by start-up Workhorse Group Inc, said Monday it has not decided whether to apply.

Representative Tim Ryan, an Ohio Democrat, criticized the proposal to kill the Energy Department program.

"This isn’t a hand-out, this is a loan," Ryan said.

The budget also again proposes killing the $7,500 electric vehicle tax credit that phases out for each automaker after they sell 200,000 EVs.

The White House blocked an effort in December by congressional Democrats to expand the credit.