(Bloomberg) -- Treasury funds have attracted the biggest inflows in more than two years in the strongest sign yet a risk-off mood is gaining momentum, according to Bank of America Merrill Lynch.

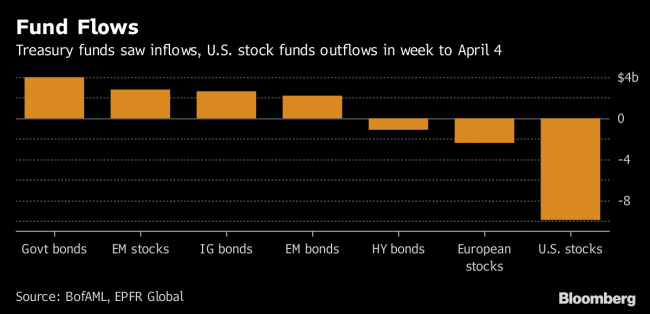

Some $4 billion went into government/U.S. Treasury funds in the week through April 4, the bank said in a report, citing data from EPFR Global. Investors pulled out $7.2 billion from stock funds, including $9.9 billion from the U.S. and $2.4 billion from Europe, while Japanese and emerging-market equity funds saw inflows.

The Treasury inflows are the “most visible expression of positioning for risk-off to date,” Bank of America strategists including Michael Hartnett in New York, wrote in the note. “We still think ‘sell-any-rip’ is a much better 2018 strategy,” than “buy-the-dip,” they said.

Investors are returning to Treasuries as the U.S. 10-year yield retreats from its 2018 high of 2.95 percent set in February. The yield declined one basis point to 2.82 percent as investors awaited the March U.S. jobs report and Federal Reserve Chairman Jerome Powell’s speech on economic outlook, both later today.

Concern about the impact of the U.S.-China trade dispute and uncertainty over the pace of Fed rate increases have capped expectations the psychologically important 3 percent level will be breached in the short-term.

Investors pulled $300 million from technology stocks and added $1.1 billion to precious metals funds. In a sign some investors are still in risk-on mode, cumulative emerging-market inflows from the start of 2004 are now at a record $363 billion, according to the report.