A breakdown could soon occur in the chart of Advanced Micro Devices (NASDAQ:AMD) if the stock breaks a support level that has formed over the past eight months. Read more to learn how to profit from this trading opportunity.A breakdown could occur in the chart of Advanced Micro Devices, Inc. (AMD) if the stock breaks the support level that has emerged over the past eight months.

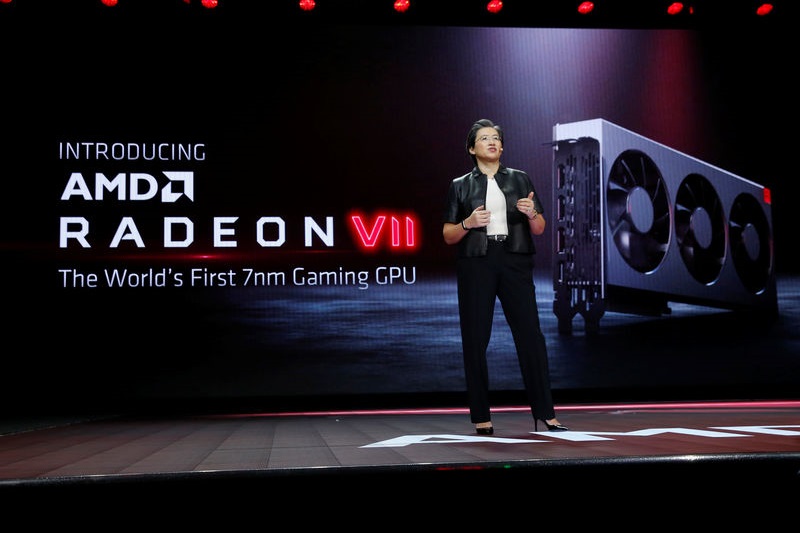

AMD designs and produces microprocessors for the computer and consumer electronics industries. The majority of the firm's sales are in the computer market via CPUs and GPUs. AMD acquired graphics processor and chipset maker ATI in 2006 in an effort to improve its positioning in the PC food chain.

AMD is benefiting from sales of its Ryzen and EPYC server processors, due to the increasing proliferation of Artificial Intelligence (AI) and Machine Learning (ML) in cloud gaming. Its acquisition Xilinx (NASDAQ:XLNX) is expected to boost its data center business. Management has also provided encouraging revenue guidance for this year.