By Ben Blanchard and Sarah Wu

TAIPEI (Reuters) -Taiwan President Tsai Ing-wen has decried what she called "rumours" about the risk of investing in the island's semiconductor industry and said the government was working hard to ensure investments continued.

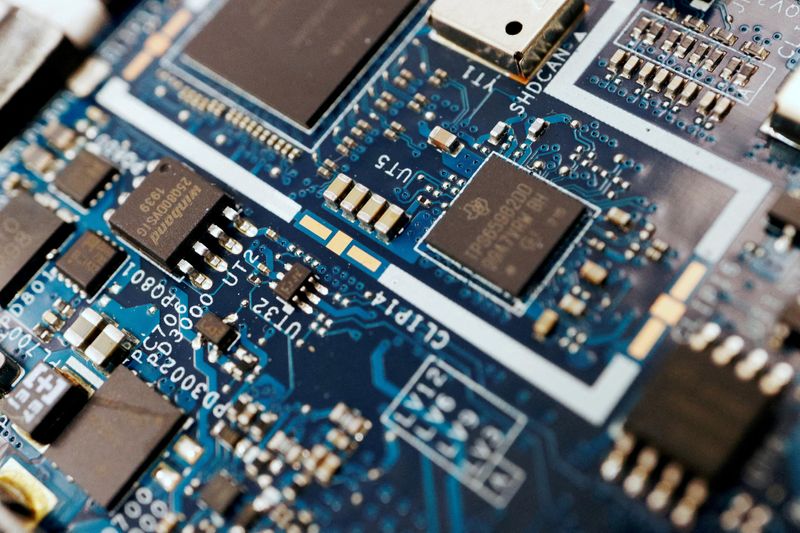

Taiwan, home to the world's largest contract chipmaker TSMC as well as several other chip manufacturers, plays an outsized role in providing chips used in everything from cars and smartphones to fighter jets.

But the Chinese military's menacing of the island to assert Beijing's sovereignty claims, especially after U.S. House Speaker Nancy Pelosi visited Taipei in August, is causing the chip industry to rethink the risk surrounding Taiwan.

Rick Tsai, the chief executive of Taiwan's largest chip designer MediaTek Inc, also told Reuters this month that U.S.-China tensions are pushing some manufacturers to talk about expanding part of their supply chain beyond Taiwan, but also said it's "incremental."

Tsai, who met with ASML Holding (NASDAQ:ASML)'s chief operations officer Frederic Schneider-Maunoury on Tuesday, praised the European manufacturer of chip-making equipment for its commitment to investing in Taiwan.

A presidential office statement quoted him as telling Tsai that the company will continue to increase its investments in Taiwan and noting that ASML has five factories and employs more than 4,500 people on the island.

"At this moment when the world is paying attention to and is concerned about Taiwan, I am very grateful to ASML for investing in Taiwan with concrete actions," Tsai said in the statement late on Tuesday.

"I believe this has also dispelled the rumours over-hyping Taiwan's risks," she added.

Tsai also said she looks forward to "Taiwan's continued deepening of cooperation with democratic allies to build a safer and more resilient global supply chain."

ASML did not immediately respond to a request for comment on the meeting.

Taiwan's Economy Minister Wang Mei-hua told reporters on Wednesday that the recent purchase of more than $4.1 billion of TSMC's stock by Warren Buffet's Berkshire Hathaway (NYSE:BRKa) Inc would "give everyone a lot of confidence".

"I think the worries that have been around recently will pass," she added.