ZURICH (Reuters) - Swiss lender Zuercher Kantonalbank's tax case with U.S. authorities is stalled without a resolution in sight, its chief executive told journalists on Friday, virtually mirroring comments he made a year ago.

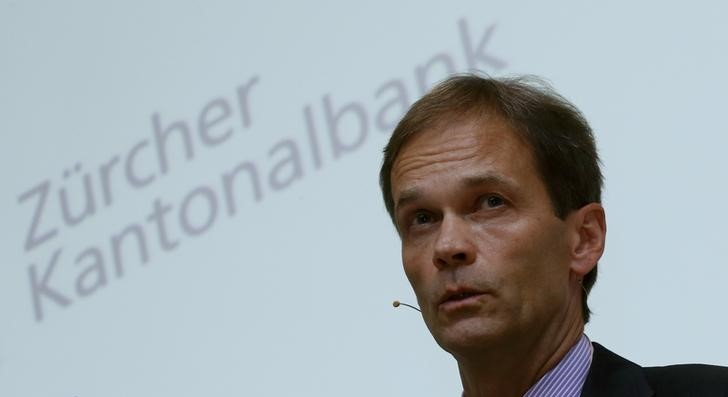

"We couldn't make progress in 2017," CEO Martin Scholl said at a news conference where he detailed last year's earnings. "We're ready at any time, but we don't know when that will be."

The U.S. Department of Justice is investigating government-owned ZKB on suspicion of helping wealthy Americans evade taxes. Two ZKB employees pleaded not guilty in 2016 to helping people hide hundreds of millions in offshore accounts.