By Jason Xue and Tom Westbrook

SHANGHAI/SINGAPORE (Reuters) - Shares in some Chinese temple operators and lottery sellers surged for a second day on Thursday amid a weak post-COVID recovery, as despondent young people rush to pray or gamble amid greater economic uncertainty.

Data showed Chinese temple visits more than quadrupled this year compared with 2022, while sales of lottery tickets jumped in April to their highest in a decade.

In stark contrast, the youth unemployment rate hit a record 20.4% in April, and multiple indicators showed economic recovery is losing steam following an initial bounce after China lifted its zero-COVID policy.

Investors took their cue from the contrasting data and snapped up relevant shares.

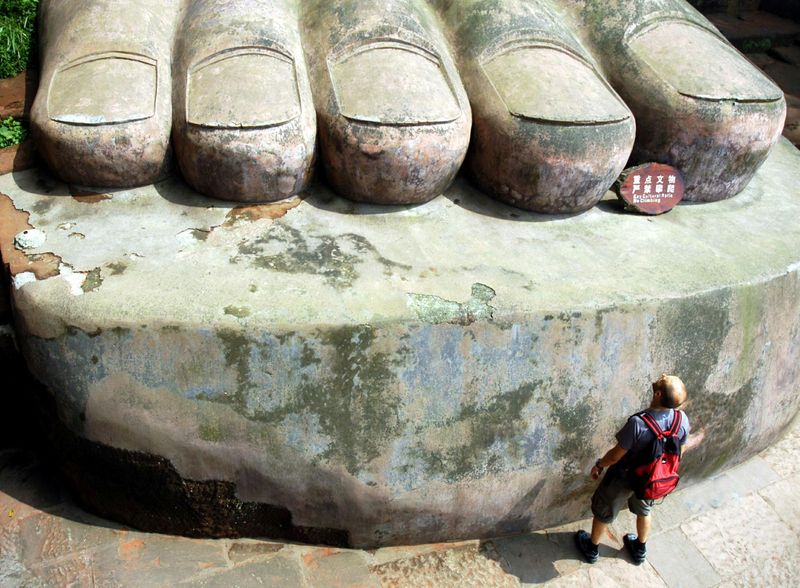

Emei Shan Tourism Co, operator of the Mount Emei scenic spot, and Anhui Jiuhuashan Tourism Development Co, operator of the Jiuhua Mountain, both saw their shares soar 10% to hit the daily limit for a second day on Thursday.

The two mountains are among China's most famous sacred Buddhist mountains, attracting millions of tourists yearly to their temples and Buddhism culture relics.

China Sports Industry Group, the listed company behind the state-run sports lotteries business, also surged 10% for two consecutive sessions.

"The surging stocks reflect a major macro-economy change this year - rising youth employment pressure," said Shi Pengfei, consumer analyst at Beijing-based Spring Capital.

"I don't expect the youth unemployment rate to see an inflection point soon as the graduation season approaches," he said. "Meanwhile, as the summer holiday comes, the youth will have more time to travel."

The sector-specific gains contrast with moves in the overall market. China's main stock benchmark has handed back most gains since last November after a reopening rally and is down 1% year-to-date, as the economic recovery missed expectations and geopolitical tensions rose.

Instead, households are turning back to safer assets and are piling into bonds and deposits, while also looking to mainly state-owned sectors such as banks, energy companies and telecoms which give reliable bond-like dividends.