By Lawrence Hurley

WASHINGTON (Reuters) - The U.S. Supreme Court on Monday left intact a court ruling that could prevent victims of Bernard Madoff's Ponzi scheme from recouping more than $4 billion from customers who withdrew money before the enterprise collapsed.

The high court left in place a December 2014 ruling by the New York-based 2nd U.S. Circuit Court of Appeals, which said federal bankruptcy law did not let the trustee Irving Picard recoup a variety of payments that Bernard L. Madoff Investment Securities LLC made to some customers more than two years before the firm collapsed on Dec. 11, 2008.

The decision does not affect the $10.69 billion that Picard has recouped for former Madoff customers, who lost about $17.5 billion of principal.

Picard's lawyers had said that if the appeals court decision were left intact, they would be barred directly from recovering about $2 billion and it would make it harder to seek a further $2 billion, putting a total of $4.3 billion in question.

Picard still needs to recover another $7 billion to achieve his goal of returning all the losses suffered by customers who filed claims.

The court rejected two related petitions, one filed by Picard and one by the Securities Investor Protection Corp, a federally chartered nonprofit that helps customers recover funds when brokerages go under.

Picard has been seeking to recoup money from customers who withdrew more from their accounts than they invested.

The appeals court said that allowing the "clawbacks" sought risked the kind of "significant market disruption" that Congress aimed to avoid by adopting protections for brokerage customers in the bankruptcy code.

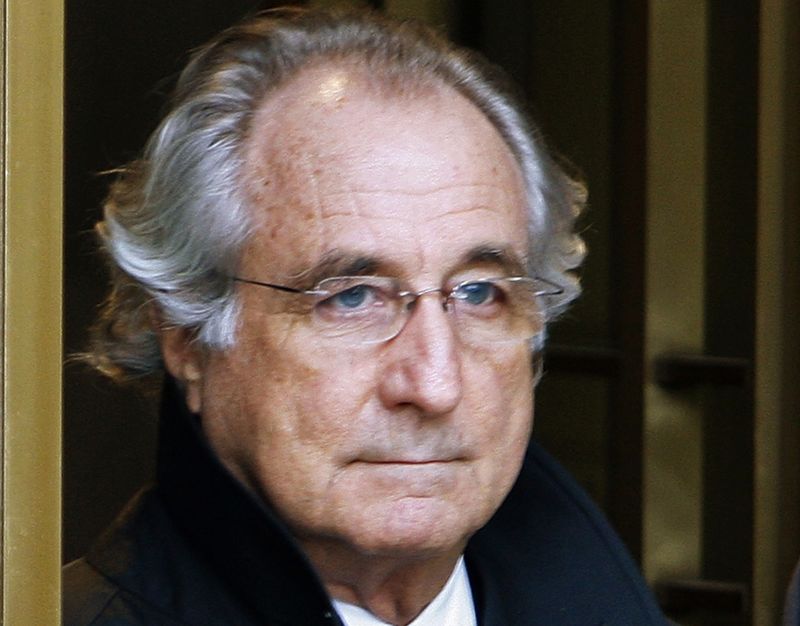

Madoff pleaded guilty in March 2009 and is serving 150-year prison term.

The cases are SIPC v. Ida Fishman Revocable Trust and Picard v. Ida Fishman Revocable Trust, U.S. Supreme Court, Nos. 14-1128 and 14-1129.