By Amrutha Gayathri and John Tilak

(Reuters) - Canada's largest oil producer Suncor Energy Inc (TO:SU) has reached a deal to acquire rival Canadian Oil Sands Ltd (TO:COS) on Monday by raising its all-stock offer, a move seen marking the end of a months-long battle for the synthetic crude asset.

The deal, valued at about C$4.24 billion ($2.93 billion), came days after Suncor's hostile bid fell short of support from Canadian Oil Sands shareholders.

Canadian Oil Sands' shares rose about 11 percent, while Suncor fell 4.7 percent.

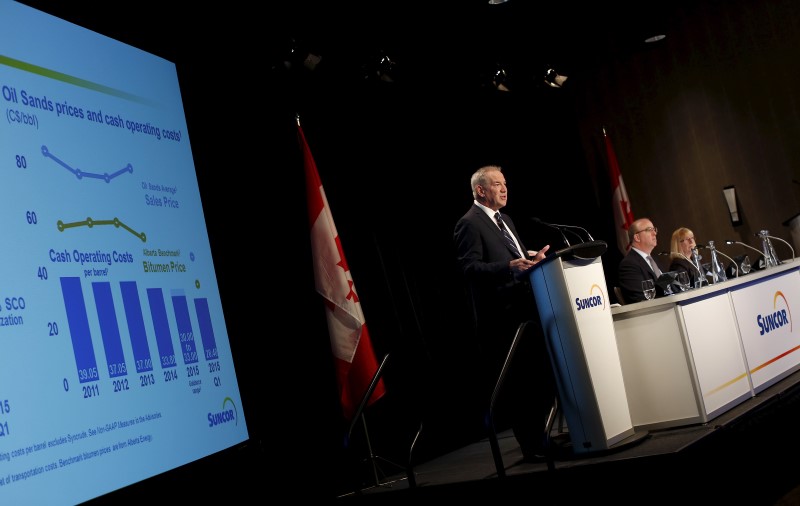

Oil sands producers have been struggling with tumbling global crude oil prices, which have slid to their lowest levels since 2003 over worries of a global supply glut.

Suncor will now offer Canadian Oil Sands shareholders 0.28 of a Suncor share for each share held, up from the initial bid of 0.25 shares. The new offer values Canadian Oil Sands at C$8.74 per share, a premium of nearly 17 percent over the closing price of both stocks on Friday.

In response to the hostile bid, Canadian Oil Sands had adopted a shareholder rights plan that acted as a poison pill, and urged investors to reject the offer.

Seymour Schulich, a major Canadian Oil Sands investor who had opposed the initial bid, said he was satisfied with the outcome.

"It's the best we could do in the environment we're in. I wish we had a better environment, but we didn't," he said in an interview. The owner of 5 percent of Canadian Oil Sands shares, Schulich was involved with the deal negotiations.

"They're going to get an overwhelming majority of the shares now."

Including Canadian Oil Sands' C$2.4 billion debt, the deal is valued at about C$6.6 billion.

With the takeover, Suncor's 12-percent stake in Syncrude - the oil-sands mining consortium in northern Alberta in which Canadian Oil Sands has a 36.7-percent stake - would rise to 49 percent.

"It makes sense from the standpoint that Suncor has a lot of value to add to Syncrude," said Scott Vali, portfolio manager and vice-president, equities at CIBC Asset Management, one of the biggest shareholders in COS.

"It's a fair price for all parties involved."

JP Morgan and CIBC World Markets are financial advisers to Suncor, while Blake, Cassels & Graydon LLP and Sullivan & Cromwell LLP are its legal advisers.

RBC Capital Markets, Osler, Hoskin & Harcourt LLP and Norton Rose Fulbright Canada LLP are advising Canadian Oil Sands.

D. F. King provided Suncor with proxy solicitation advice, and Kingsdale advised Canadian Oil Sands.