By Peter Nurse

Investing.com - European stock markets are set to open higher Wednesday, with investors buoyed by optimism about a coronavirus vaccine as well as the chance a key EU summit will lead to more stimulus.

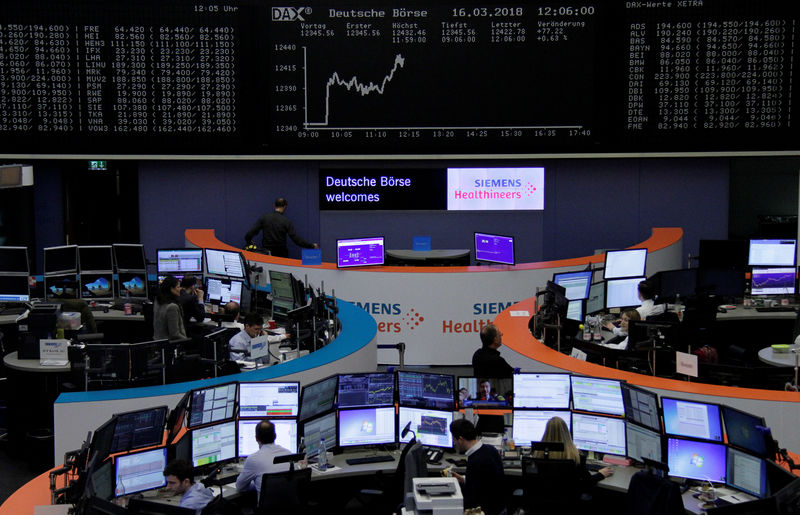

At 2:05 AM ET (0605 GMT), the DAX futures contract in Germany traded 0.7% higher, the FTSE 100 futures contract in the U.K. rose 1%, while CAC 40 futures in France gained 1.1%.

Helping the positive tone Wednesday was the news that the first Covid-19 vaccine tested in people has shown early promising results.

U.S. biotech firm Moderna 's (NASDAQ:MRNA) experimental Covid-19 vaccine was declared safe and generated “robust” immune responses in all 45 volunteers taking part in the study, according to early-stage human trial results published in the New England Journal of Medicine on Tuesday.

“This does not mean that it may lead to a vaccine in the end, but it is an important step towards finding a vaccine,” said analysts at Danske Bank, in a research note.

.However, Japan’s capital Tokyo raised its warning level to the highest level, and three U.S. states reported new record daily deaths from the pandemic.

That said, there are hopes the European Union could agree at its summit later this week on a rescue financing package that will limit the economic damage to the bloc.

Additionally, the European Central Bank is set to meet Thursday, but isn't expexted to ease its policy any further this time.

In corporate news, Svenska Handelsbanken (ST:SHBa) posted a 6.1% drop in second-quarter net profit as lower interest rates dented income, but the profit decline was smaller than expected thanks to lower costs and a sharp fall in credit losses.

U.K. luxury group Burberry (LON:BRBY) said it expects sales for the six months through September to be down around 15%-20% from a year earlier, despite a solid recovery in demand since April.

TomTom (AS:TOM2) posted a net loss for the second quarter of 2020, but the Dutch navigational-technologies company added its operational revenue was on track to recover from the lows it experienced in April due to the coronavirus pandemic.

Oil prices pushed higher Wednesday, helped by a sharp fall in U.S. crude inventories of 8.3 million barrels in the week to July 10, according to data from industry group the American Petroleum Institute. Official numbers from the Energy Information Administration are due later Wednesday.

The so-called OPEC+ bloc is set to decide whether to extend output cuts of 9.7 million barrels per day that end in July or ease them to 7.7 million barrels per day.

At 2:05 AM ET, U.S. crude futures traded 0.5% higher at $40.48 a barrel, while the international benchmark Brent contract rose 0.3% to $43.03.

Elsewhere, gold futures fell 0.2% to $1,809.10/oz, while EUR/USD traded at 1.1401, up 0.1%.