Investing.com’s stocks of the week

Investing.com -- Milan-listed shares in Stellantis (BIT:STLAM) rose on Tuesday after the Chrysler-owner said it does not expect a prolonged series of strikes at its plants to change the company's profitability and cash goals.

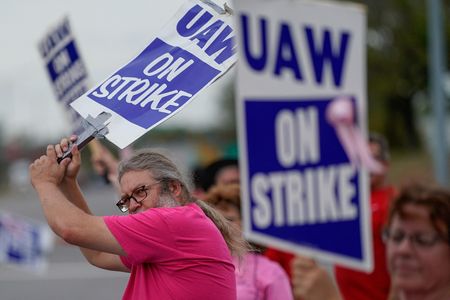

Six weeks of strikes over pay at factories in the U.S. and Canada are due to cost the group behind brands like Jeep and Peugeot €3 billion in revenues and less than €750 million (€1.0598 = $1) in income, Chief Financial Officer Natalie Knight said in a media briefing. Stellantis has signed a tentative agreement to end the strikes with the United Auto Workers and Unifor unions.

The profit amount would be smaller than similar costs from the labor actions that have impacted Stellantis' U.S. rivals General Motors (NYSE:GM) and Ford (NYSE:F), Knight noted. GM has projected an earnings hit of no less than $1B, while Ford anticipated that the strikes would take a $1.3B bite out of its annual adjusted operating income.

In the third quarter, revenues at Stellantis jumped by 7% to €45.1 billion, topping Bloomberg consensus estimates of €43.3B, as solid sales outside of North America partially helped offset foreign exchange headwinds.

The firm also reiterated its full-year guidance for double-digit adjusted operating margin and positive industrial free cash flows, adding that its €1.5B share buyback program is "on track" to finish in its financial fourth quarter.