CHICAGO (Reuters) - Illinois' new budget does little to tackle the state's financial problems like escalating pension contributions and a structural deficit, dimming prospects for a credit rating upgrade, S&P Global Ratings said on Tuesday.

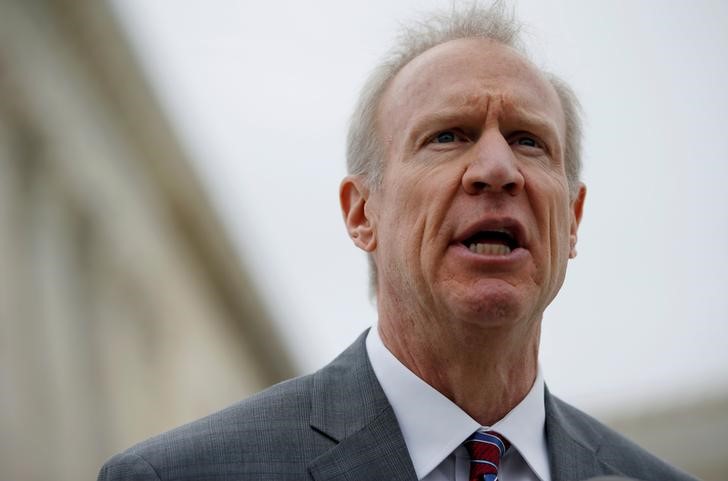

The $38.5 billion fiscal 2019 budget was signed into law on Monday by Governor Bruce Rauner following its bipartisan approval by state lawmakers last week in a marked departure from a political impasse that left Illinois without complete budgets for an unprecedented two straight fiscal years.

"While the emergence of a more collaborative budget process has potentially constructive credit implications, the substance of the package largely represents an extension of the status quo," S&P said in a report.

The credit rating agency, which rates Illinois' general obligation bonds a notch above junk at BBB-minus, added that the state has made little headway in dealing with a chronic backlog of unpaid bills that stood at $7.1 billion on Tuesday aside from selling $6 billion of bonds last year to shrink the bill pile.

"This, along with the state's long-term liabilities, precariously balanced operating budget, and lack of budget reserve, continue to weigh on the state's prospects for a

higher rating," the report said.

There was no immediate comment from the governor's office.

Rauner and other state officials have expressed disappointment that the bill backlog was left unaddressed in the budget, which includes a bond-financed voluntary buyout of pensions or retirement benefits to save $423 million.

S&P called the projected savings uncertain, adding that "booking these savings upfront implies they will not dent the steep upward sloping pension contribution schedule facing the state." Those contributions were projected by a legislative commission to climb from $7.8 billion this fiscal year to $10 billion in fiscal 2023.

The budget for the fiscal year that begins July 1 also includes one-time measures such as $800 million of interfund borrowing and $270 million from the sale of the state's main office building in Chicago, according to S&P. It warned that an upward trend in state tax revenue, apart from last year's income tax rate hikes, may be due to an a nonrecurring windfall triggered by new federal tax law changes enacted in December.

"Assuming this begins to dissipate in 2019 and beyond, the state's fiscal condition is susceptible to erosion," the report said.