By Brenda Goh and Pei Li

SHANGHAI (Reuters) - Starbucks Corp (O:SBUX) is partnering with Alibaba (N:BABA) to deliver its coffee in Chinese cities starting this fall, betting the move will revive sales growth in its second-largest market that is witnessing aggressive local competition.

Starbucks flagged in June that it was pursuing such a tie-up after reporting a sudden slowdown in China sales growth, which it blamed partly on a crackdown on third-party delivery firms that had previously helped drive orders at its cafes.

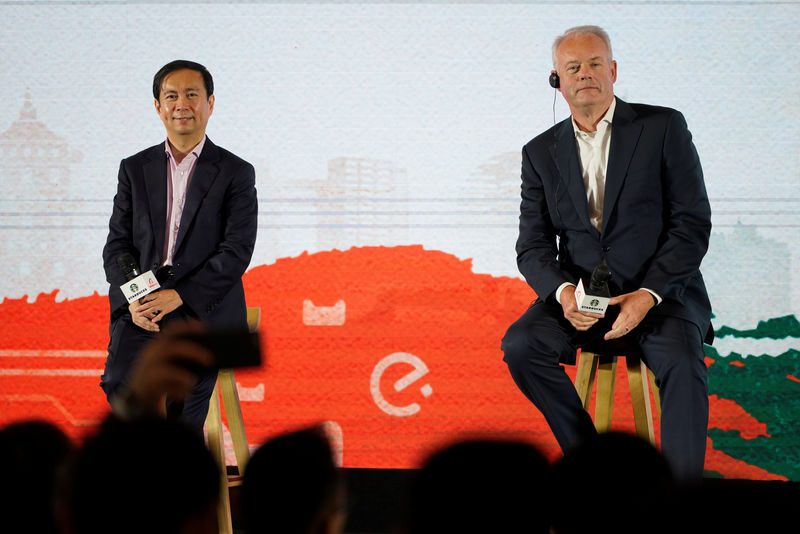

"I consider this strategic partnership to be one that ... will just be rocket fuel for Starbucks' growth and continued expansion in China," Starbucks Chief Executive Kevin Johnson told reporters in Shanghai on Thursday.

The Seattle-based company will pilot delivery services from 150 Starbucks stores in Beijing and Shanghai and plans to expand that to more than 2,000 stores across 30 cities by the end of the year, Starbucks and Alibaba said in a joint statement.

Starbucks expects to start seeing some of the benefits from the partnership in the next quarter and the full impact in 2019, Johnson said.

The companies will collaborate across businesses within the Alibaba group, including delivery platform Ele.me, supermarket chain Hema, online retailers Tmall and Taobao, and mobile and online payment platform Alipay. Starbucks will also open a virtual store on Alibaba's platforms where customers can buy Starbucks merchandise, they said.

The delivery program will leverage Ele.me's 3 million registered riders, with an aim of delivering orders within half an hour. Starbucks will establish "Starbucks Delivery Kitchens" inside Hema stores and use the supermarket's delivery system to fulfill Starbucks delivery orders.

Starbucks had no formal online delivery in China before this deal.

Instead, unapproved third-party delivery services had filled that gap by picking up bulk orders for their own customers. Analysts have said an official delivery arrangement would push up costs for Starbucks.

Starbucks said its delivery menu will only contain items that can meet its half-hour deadline, but did not specify whether it will charge for the deliveries. Its pilot delivery program in Manhattan and Seattle a few years back fizzled partly because it charged too much: $5.99 per delivery.

Luckin Coffee, a local startup that wants to go toe-to-toe with Starbucks, charges less than $1 per order and has said its deliveries took an average of 18 minutes.

Starbucks and Alibaba did not give financial details of the partnership and declined to say whether the companies had discussed taking equity stakes in each other.

Some parts of the agreement, including the Ele.me tie-up was exclusive, while others were not, Starbucks executives said. The partnership had been discussed for more than a year, the companies said.

OPPORTUNITY = COMPETITION

China has offered Starbucks rich pickings in recent years, thanks to a burgeoning cafe culture which has helped offset saturation in the United States. It has 3,400 stores in the country and plans to almost double that number by 2022.

But there is pressure from local companies such as Luckin, which has expanded rapidly and offers cheap delivery, online ordering, big discounts and premium pay for its staff.

Luckin said on Wednesday it planned to more than double its number of stores in China to 2,000 by the end of 2018.

Johnson acknowledged the competition but added that the significant opportunity in China made that unsurprising.

Starbucks' move to offer delivery "is in part to make sure they don't fall behind Luckin Coffee in terms of offering high quality delivery services" to a customer group of young office workers who do not want to stand in line, said Ben Cavender, an analyst at China Market Research Group.

The partnership is also a leg up for Ele.me in its race for market share in the Chinese delivery market against Meituan-Dianping, which is backed by gaming giant Tencent Holdings (HK:0700).

Ele.me said last week that it will spend more on subsidies at a time when Meituan is preparing for a $4 billion Hong Kong listing.