By Rajesh Kumar Singh and Shivansh Tiwary

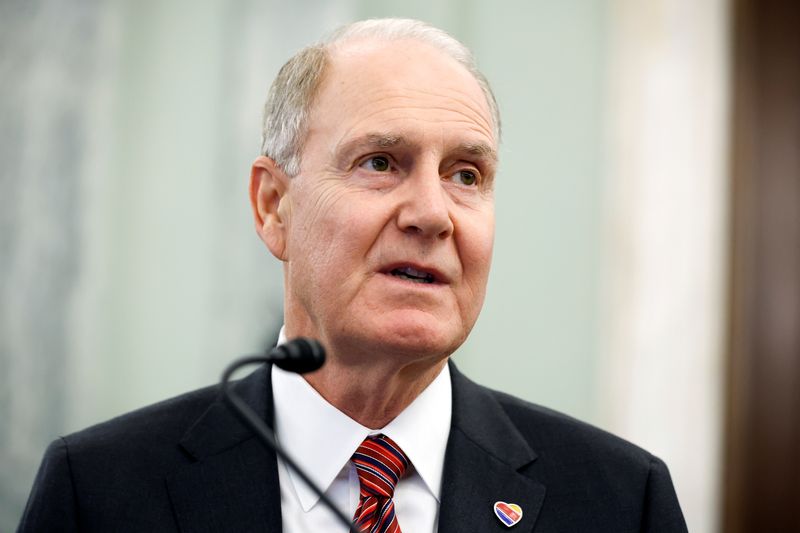

(Reuters) -Southwest Airlines on Tuesday announced changes to its board including the retirement of Chairman Gary Kelly, but reiterated its support for CEO Bob Jordan despite calls for a shakeup from activist investor Elliott Investment Management.

Kelly has worked at the U.S. carrier for nearly four decades and has been chairman since founder Herb Kelleher retired in 2008. He served as the company's CEO for 18 years before handing the reins to Jordan in 2022.

Elliott, among the world's most powerful activist investors, has launched a boardroom battle, demanding the ouster of both Kelly and Jordan. It wants Southwest to change management's "rigid commitment to a decades-old approach", and has laid out plans to replace two-thirds of the board's 15 directors.

Elliott now holds a large enough stake in the company to call a special shareholder meeting.

In a letter to shareholders after a meeting with Elliott in New York on Monday, Kelly said his role as chairman was always meant to be transitional and would end next year in the spring after Southwest's annual meeting.

Both Southwest and Kelly expressed confidence in Jordan's leadership.

"Bob has a proven track record over decades," Kelly said. "Most importantly, he has what it takes to lead Southwest through a significant transformation."

As part of the overhaul, six directors will voluntarily step down in November. Southwest plans to appoint four new independent directors in the near term, which would potentially include up to three candidates proposed by Elliott.

The airline's board has set up a new finance committee to oversee financial, operational, and business plans and strategies and capital structure, among other things.

Southwest's shares, which have fallen about 38% in the past three years, were down about 3.5% at $28.70 in mid-day trade.

Analysts at Citi said the board changes were "adjustments to Southwest's strategic positioning," rather than "an attempt to reinvent the wheel."

Elliott called the changes "unprecedented" and said it was pleased that Southwest's board was "beginning to recognize the degree of change that will be required" at the company.

"The need for thoughtful, deliberate change at Southwest remains urgent," it said in a statement, adding its nominees are "the right people to steady the board and chart a new course for the airline."

Southwest has been struggling to find its footing after the pandemic. It has been hit hard by its over-reliance on Boeing (NYSE:BA), for its fleet due to regulatory and safety struggles that have reduced the jetmaker's ability to deliver new planes.

It has also been facing pricing pressure as an industry-wide overcapacity in the domestic market has dampened airfares.

To turn around its fortunes, it plans to offer assigned and extra-legroom seats to attract premium travelers, and start overnight flights.

It is due to share more details on Sept. 26.