By Abigail Summerville and Anirban Sen

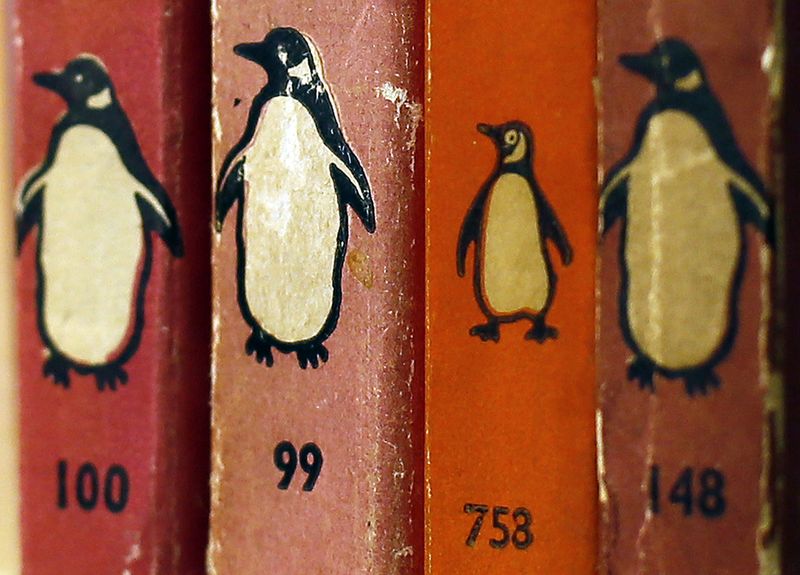

NEW YORK (Reuters) - Book-publishing powerhouse Simon & Schuster's owner will let its $2.2 billion sale to Penguin Random House collapse on Monday, opening the door for a new suitor to try to clinch a deal, according to people familiar with the matter.

The acquisition was blocked on Nov. 1 by a federal judge on antitrust grounds. German media group Bertelsmann SE & Co, which owns Penguin, was unable to convince Paramount Global, Simon & Schuster's current owner, to help launch an appeal and extend the deal contract before it expires on Monday, the sources said.

Bertelsmann will owe Paramount a $200 million break-up fee as a result of the transaction falling apart.

The sources requested anonymity ahead of official announcements this week. Paramount declined to comment, while a Bertelsmann spokesperson did not respond to a request for comment.

The U.S. Justice Department had sued to stop the tie-up of the two publishers, which combined would have accounted for more than 25% of all print books sold in the United States this year.

In its complaint, it argued the deal would lead to lower earnings for authors because of the reduced competition. Best-selling author Stephen King testified in favor of the government's arguments during the trial.

Penguin writers include cookbook author Ina Garten and novelists Zadie Smith and Danielle Steele, while Simon & Schuster publishes King, Jennifer Weiner and Hillary Rodham Clinton, among others.

The top five U.S. publishers are Penguin, HarperCollins, Macmillan, Simon & Schuster and Hachette.

Following a collapse of the deal, Paramount will be free to explore a sale of Simon & Schuster anew. Previously known as ViacomCBS (NASDAQ:PARA), Paramount had inked the Penguin deal so it could focus on its video and streaming businesses.

HarperCollins, which is controlled by News Corp (NASDAQ:NWSA), and Lagardere SCA's Hachette Book Group have previously expressed interest publicly in buying Simon & Schuster.

HarperCollins also unsuccessfully bid for Simon & Schuster when it was put up for sale by Paramount in early 2020.

HarperCollins and Hachette did not respond to requests for comment.