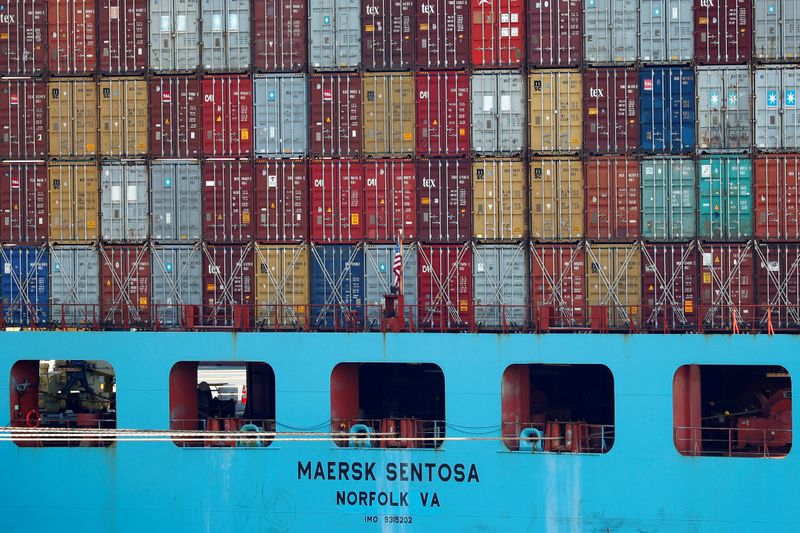

COPENHAGEN (Reuters) - Shipping group Maersk (CO:MAERSKb) said on Wednesday positive momentum in global trade allowed it to look confidently beyond 2020 and it would initiate a share buy-back programme of around $1.6 billion.

Maersk, the world's biggest container shipping line, has recovered faster than expected after the pandemic halted trade around the world, benefiting from higher retail sales in the United States.

The company on Tuesday raised its full-year earnings forecast, citing increased momentum in the fourth quarter in global container volumes and freight rates.

"Demand has begun to partially recover," Chief Executive Soren Skou said in a statement.

"Our progress in earnings and in our transformation allows us to look confidently past the extraordinary 2020," he said.

Surging shipments into the United States have fuelled record high freight rates, but the industry has said the rally could slow because of new COVID-19 lockdown measures.

Maersk said the decision to launch a share buy-back programme of up to 10 billion Danish crowns ($1.60 billion) was "supported by the strong earnings and free cash flow generation seen in 2020".

In line with preliminary numbers announced last month, Maersk said third-quarter sales fell slightly from last year to $9.92 billion, while earnings before interest, tax, depreciation and amortisation (EBITDA) rose 39% to $2.3 billion.

($1 = 6.2680 Danish crowns)