(Bloomberg) -- The dollar bonds of Shimao Group Holdings Ltd. extended losses to record lows despite assurances from a unit of the firm that business activities were normal. The property developer’s shares fell as much as 5% to the lowest in more than a decade.

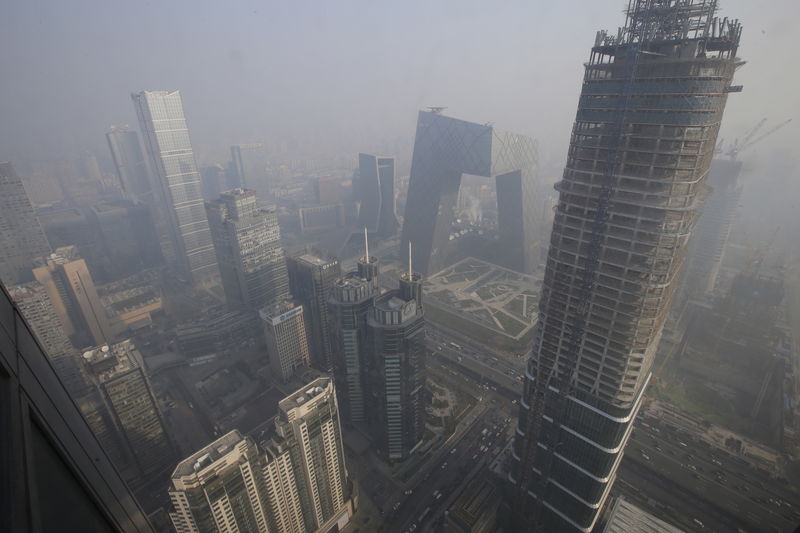

Chinese growth slowed further in November as a worsening real-estate market slump and Covid disruptions weighed on the world’s second-largest economy. The data highlights the impact of the property sector woes and the scale of the challenge facing the Chinese government in stabilizing the economy.

China Evergrande Group’s units have been asked to halt asset disposals by a working team sent to the developer’s headquarters in Guangzhou as it assesses the true picture of Evergrande’s assets and liabilities, Caixin Magazine reported.

Key Developments:

- Why Hidden Debt Is a Big Problem for China Developers: QuickTake

- Hong Kong’s Property Tycoons Sacrifice Profit to Appease Beijing

- China Developers Sink as Shimao Deal Stokes Governance Concern

- Shimao Deal Is ‘Red Flag’ Amid Liquidity Concern, JPMorgan (NYSE:JPM) Says

- What’s Next for China Evergrande, Crushed by Debt: QuickTake

- Hard Landing in Property Market Would Crater China’s Economy

Shimao Dollar Bonds Tumble to Record Lows, Shares Also Sink (10:03 a.m. HK)

Shimao dollar bonds fell 3 to 5 cents on the dollar Wednesday morning, according to credit traders, extending losses to all-time lows. The company’s 4.75% note due 2022 dropped 5.8 cents on the dollar to 58.2 cents, set for another record low after the bond tumbled 15.8 cents the previous day, according to Bloomberg-compiled prices as of 9:58 a.m. in Hong Kong.

China’s Economy Slows in November as Property Slump Deepens (10:03 a.m. HK)

Industrial output rose 3.8% from a year earlier, quickening from 3.5% in October and above 3.7% projected by economists. Retail sales growth weakened to 3.9%, missing economists’ forecasts of a 4.7% gain.

Growth in fixed-asset investment eased to 5.2% in the first eleven months of the year. Property investment grew by 6% in the same period, slowing from 7.2% during the January-October period, as financing rules remained strict and home sales plunged amid weak sentiment.

Chinese Developer Sunac’s Dollar Bonds Continue to Fall (9:48 a.m. HK)

Sunac China Holdings Ltd.’s dollar notes extended their declines, with some sliding 2 cents on the dollar, according to credit traders. The firm’s 7.95% 2022 note fell 1.5 cents to 77.4 cents, Bloomberg-compiled data show.

China Home Market Slump Deepens as Prices Fall for Third Month (9:30 a.m. HK)

China’s home prices fell for a third consecutive month in November, adding to a property industry slump that’s hurting the economy.

New-home prices in 70 cities, excluding state-subsidized housing, declined 0.33% last month from October when they fell 0.25%, National Bureau of Statistics figures showed Wednesday. Values in the secondary market slid 0.37%, down for a fourth month.

Shimao Unit Says Business as Usual, Has Ability (OTC:ABILF) to Repay Debt (9:14 a.m. HK)

A unit of Shimao said its business activities are normal and there’s no event that would affect its ability to repay its bond principal and interest.

The statement from Shanghai Shimao Co. on Tuesday evening came as the Shanghai stock exchange asked the firm to “prudently assess” the impact of related debt given recent attention on borrowings of the listed company and its controlling shareholder. The bourse also asked Shanghai Shimao to justify a planned sale of real estate management assets to Shimao Services Holdings Ltd. and explain whether the deal would hurt smaller shareholders.

Banks in China Boomtown Cut Mortgage Rates Amid Property Crisis (8:24 a.m. HK)

Banks in the southern town of Shenzhen have cut mortgage rates, following government calls to ease property curbs amid the widening debt crisis for developers. Some lenders in the nation’s least affordable residential market lowered first-home mortgage rates to 4.95% from 5.1%, state broadcaster CCTV reported, citing local real-estate agents. Mortgage rates for second homes in the city were reduced to 5.25% from 5.6%.

China’s top leaders this month signaled an easing of their clampdown on the real-estate industry to bolster home sales and support the economy as a residential market downturn and sporadic virus outbreaks weigh on the outlook.

Evergrande Asked to Halt Assets Disposal for More Facts: Caixin (6:50 a.m. HK)

The government work team from Guangdong Province sent to Evergrande told regional companies of Evergrande Group to suspend handling all asset disposals, Caixin Magazine reported, citing an unidentified person from Evergrande.

The person said Guangdong government team gave notice to Evergrande units on Dec. 12, adding the decision should be intended for the government team to sort out the true picture of Evergrande’s assets and liabilities, according to Caixin.

Why Hidden Debt Is a Big Problem for China Developers: QuickTake (5 a.m. HK)

Turmoil in China’s junk bond market has been testing investors’ nerves -- and that’s just concerning the debt they knew about. It turns out that property developers including Evergrande, Kaisa Group Holdings Ltd., Fantasia Holdings Group and Agile Group Holdings also have lots of opaque liabilities that may or may not be reflected on their balance sheets, making it hard to assess the companies’ true credit risks.

A spate of defaults -- most notably by Evergrande and Kaisa -- have undermined confidence in China’s economy and led to mounting pressure on developers to reveal their hidden leverage. At least one has committed to no longer issuing this type of debt.

©2021 Bloomberg L.P.