Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Investing.com -- Shares in Las Vegas Sands Corp (NYSE:LVS) ticked up by more than 3% in after-hours trading, in spite of a 30% earnings dip by the multinational casino resort company during its second quarter of 2015.

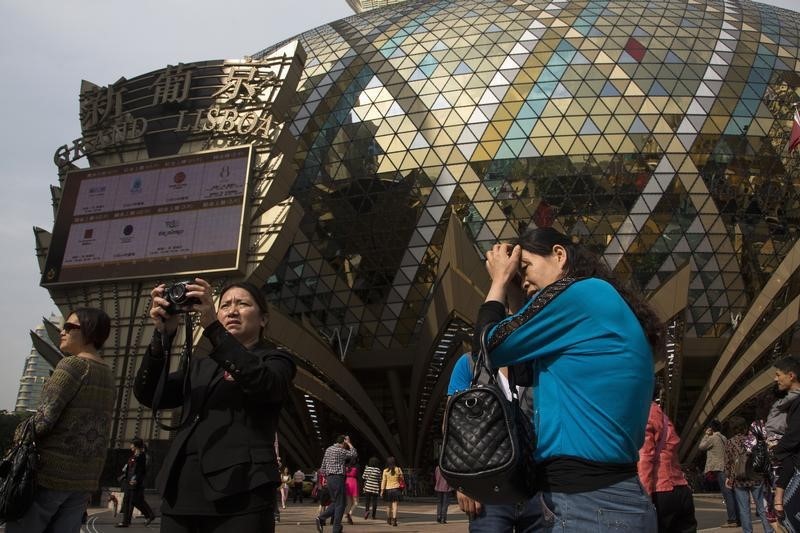

Continuing struggles in the company's Macau resort in Southeast China dented the company's earnings during the quarter. For the month of June, gambling revenue from the Macau division plunged by 36% marking its 13th straight month of monthly declines. In total, the Sands China resort saw its revenue drop by 27% on the quarter to $1.77 billion.

Investors, however, may have anticipated even sharper declines in Macau, amid efforts by the Chinese government to crackdown on corruption. The measures have created significant losses for casinos in Macau over the last year.

"Our convention-based Integrated Resort business model appeals to the broadest set of customers, generates the most diversified set of cash flows, and delivers the industry's highest revenue and profit from non-gaming segments while bringing unsurpassed economic and diversification benefits to the regions in which we operate. We remain confident in our ability to both further extend our global leadership position and deliver strong growth in the future," LV Sands CEO Sheldon Adelson said in a statement.

Overall, Sands saw its earnings fall 30% on the quarter to $469.2 million or 0.59 per share. By comparison, the casino resort reported earnings of $671.4 million or 0.83 per share in the second quarter of 2014. Excluding pre-opening expenses, the company's revenue fell 19% to $3.09 billion during the period. Analysts expected Sands to earn revenue of $2.99 billion or 0.60 per share.

"The prudent management of our cash flow, including the ability to increase the return of capital to shareholders while maintaining a strong balance sheet and ample liquidity to invest in future growth opportunities, remains a cornerstone of our strategy," Adelson added.

Shares in Las Vegas Sands gained 1.85 or 3.36% to 54.98 in after-hours trading.