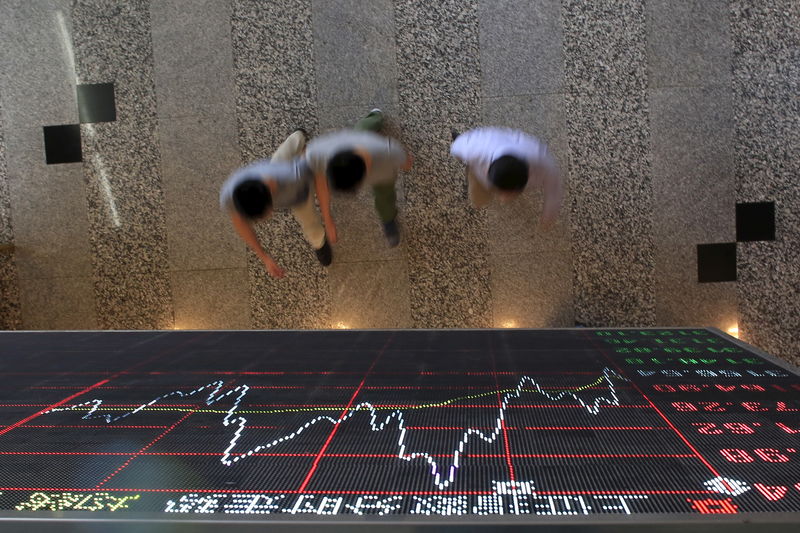

SHANGHAI/HONG KONG (Reuters) - Chinese President Xi Jinping unveiled plans on Monday to launch a technology board in Shanghai that will adopt a loosely-regulated mechanism for initial public offerings (IPOs), potentially competing with Hong Kong, or even New York.

The announcement on the "technology innovation board", to be established by the Shanghai Stock Exchange, comes as Beijing is stepping up support toward the private sector, and encouraging innovation, to mitigate the impact of the Sino-U.S. trade war.

Xi announced the decision at the start of the China International Import Expo in Shanghai, but gave few details, only saying the new board will adopt a registration-based IPO system. Under the current system, all mainland IPOs must be vetted by regulators.

Suggesting a lower listing threshold, the Shanghai Stock Exchange said in a statement on Monday that the new board will make "more appropriate and differentiated arrangements" regarding companies' profitability and shareholding structures, and will be more inclusive toward innovators.

"This could be China's Nasdaq," said Yang Hai, analyst at Kaiyaun Securities.

"It will post a challenge to Hong Kong," he said, adding Shenzhen's tech-heavy ChiNext board could also feel the pressure.

Chinese and Hong Kong bourses have stepped up their competition to attract tech firms seeking IPOs. Earlier this year Hong Kong introduced rules allowing companies with dual-class shares to list in the city, while China pursued Chinese Depositary Receipts (CDRs) as a way to entice overseas-listed Chinese tech giants to list domestically.

Adopting a western-style registration-based IPO system would give market forces a dominant role in deciding when a company can sell shares publicly, removing regulatory hurdles facing many Chinese listing candidates.

The Shanghai Stock Exchange said on Monday that legal hurdles for such an IPO system were removed in December, 2015, and the bourse will encourage small investors to invest in the technology innovation board via mutual funds, so that they can share growth of innovative companies.

But Huang Sheng, veteran investor and chairman of peer-to-peer company Shenzhen Xitou Finance Service Co, said launch of a new tech board is "not a good thing."

"There is a liquidity shortage in the stock market. How can the market handle a new board?" he wrote.

In addition, "Without a sound legal, and delisting mechanism, adopting the registration-based IPO system will lead to many garbage, and fraudulent companies getting listed."