By Krystal Hu

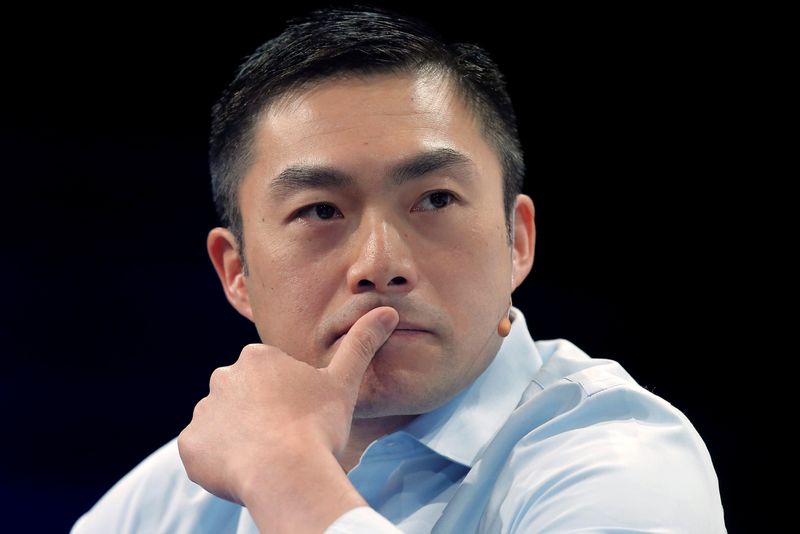

(Reuters) -Sequoia Capital has lowered management fees in its two recently-launched venture funds as it braces for a slower investment environment, partner Alfred Lin said on Thursday.

The changes in fee structure, communicated to investors in December, allow limited partners (LPs) who committed capital to Sequoia's crypto and ecosystem funds launched early last year to pay management fees based on capital deployed, rather than the common model of capital under management that applies to other Sequoia funds.

Sequoia launched a $950 million ecosystem fund to back funds managed by others, including scouts and those launched by Sequoia network, and a $600 million crypto fund to invest in crypto companies and tokens. So far, 10% of the crypto fund has been deployed, Lin said.

The move marks an unusual concession by the world’s top venture investor after U.S. venture capital deals fell from their 2021 peak by 31%. Sequoia's longstanding relations with LPs has been tested by the nosedive in valuation in tech companies and the fallout in its portfolio company FTX.

Speaking at the StrictlyVC event on Thursday, Lin defended the firm's due diligence, saying it had launched internal processes that concluded extensive research, and due diligence had been done on FTX.

"We were misled for a variety of situations," Lin said.

The U.S. Securities and Exchange Commission (SEC) has made inquiries into the due diligence processes of some investors in FTX.

Sequoia marked down its investment in FTX, including $150 million out of its third Global Growth Fund and $63.5 million into FTX and FTX US from its crossover fund to zero. Lin said the firm remained committed to crypto investment.

"We will invest through a slower time but we will also continue to advance. We are a long-term optimist in crypto and in a variety of other sectors," said Lin, who also led investment in Citadel Securities and DoorDash .