By Lisa Lambert

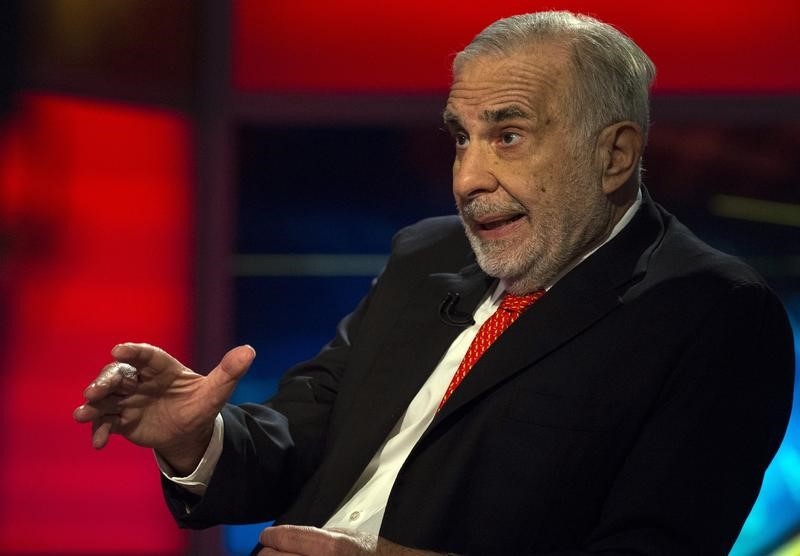

WASHINGTON (Reuters) - Two prominent U.S. Democratic senators are raising questions about President Donald Trump's special adviser, Carl Icahn, asking in a letter on Thursday if the activist investor is attempting to persuade the government to lift its "too big to fail" tag from insurer American International Group.

On Friday, the Financial Stability Oversight Council, comprising the chiefs of U.S. financial regulatory agencies, will discuss AIG's designation as a "systemically important financial institution," commonly known as one that is "too big to fail." In an agenda for the meeting, the council did not say which institution it will discuss.

However, there are only two non-banks designated as so large and interconnected that they would ruin the financial system if they failed - AIG and Prudential (LON:PRU) Insurance (N:PRU). The labels trigger stricter oversight and greater capital requirements.

Trump has ordered a review of the designation process, currently at the heart of a lawsuit involving MetLife Inc. (N:MET), which many expect will lead his administration to rescind the current designations to try to lighten regulation it considers burdensome.

In a letter to U.S. Treasury Secretary Steve Mnuchin, Senators Elizabeth Warren and Sheldon Whitehouse said Icahn has retained "his massive business interests" while advising Trump on regulation, including his sizable investment in AIG (N:AIG).

AIG company received a $182 billion taxpayer bailout during the 2007-09 financial crisis, which prompted Congress to call for the designations of non-banks in the Dodd-Frank Wall Street reform law as systemically important.

Icahn owned a 4.95 percent stake in AIG as of March 31. Concerned about compliance costs, Icahn had publicly pressed AIG to shrink, and tried to convince the FSOC that AIG no longer qualified for the label. Recently though, after AIG sold some assets and appointed a new chief executive, Icahn has not pushed the issue further.

Senators Warren and Whitehouse also noted Icahn met with one current FSOC member, Securities and Exchange Commission (SEC) Chair Jay Clayton, after Clayton was nominated for the position.

"Given Mr. Icahn's recent modification of his position on the breakup of AIG, and his past interactions with administration officials, we write to seek assurances that Mr. Icahn has not provided input on or received information on the pending FSOC decision on AIG's SIFI status," they said.

The two senators asked about any FSOC measures to ensure individuals with an interest in its decisions do not inappropriately influence its members. They also asked if any members are subject to recusal on AIG because of interactions with Icahn, and about any staff-level conversations regarding Icahn's investments.

AIG declined to comment, and the White House and Treasury did not respond to requests for comment.