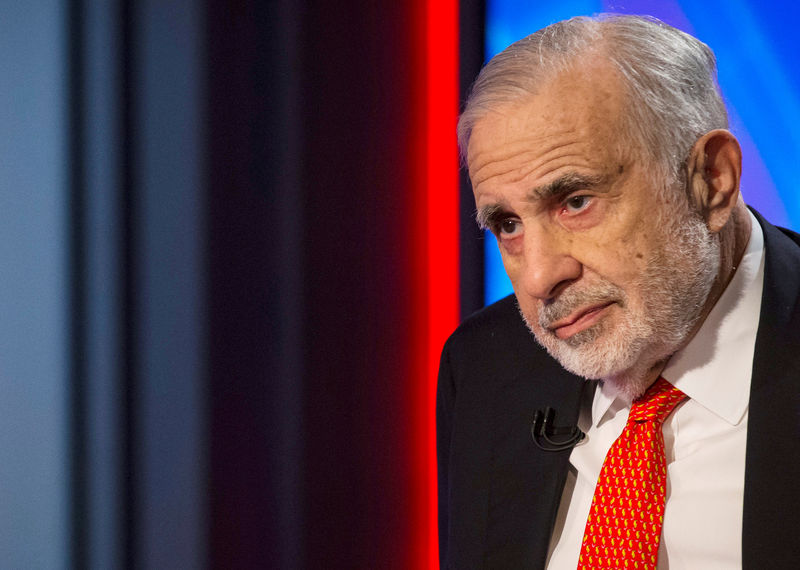

(Reuters) - Shares of SandRidge Energy jumped 14.2 percent on Friday, after activist investor Carl Icahn disclosed a big stake in the oil and gas producer and said he would oppose its $746 million bid for rival Bonanza Creek Energy.

Bonanza Creek's shares fell 6.3 percent to $30.13 in early trading. The shares are yet to touch SandRidge's offer price of $36 since the bid was announced on Nov. 15.

Icahn, who on Wednesday revealed a 13.51 percent stake in SandRidge, is the second investor to oppose the proposed buyout.

Earlier this week, Fir Tree Partners, which owns about 8.3 percent of SandRidge, had criticized the proposed deal, saying the deal would drain all of the company's cash.

Icahn, whose stake makes him the largest shareholder in SandRidge as per Thomson Reuters data, said on Wednesday he had not spoken with Fir Tree, but agreed with the hedge fund's reasons for opposing the deal.

SandRidge emerged from bankruptcy late last year, while Bonanza did so in April following a recovery in oil prices after a two-year slump.

SandRidge is looking to buy Bonanza Creek to expand its presence in the Denver-Julesburg Basin of Colorado.

Shares of SandRidge pared some of their gains and were up 6.4 percent at $18.61 in morning trading on Friday. The shares are down about 21 percent since the start of the year.