By Jody Godoy and Luc Cohen

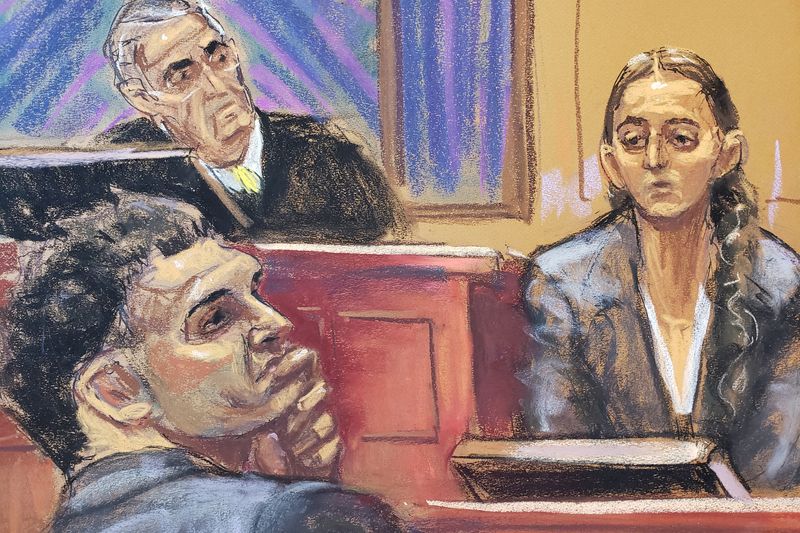

NEW YORK (Reuters) -Caroline Ellison, Sam Bankman-Fried's confidant who has pleaded guilty to helping him take billions in FTX customer assets, testified at his fraud trial on Wednesday that she had been "terrified" the truth would come out about the cryptocurrency exchange and that its ultimate collapse last year brought an "overwhelming feeling of relief."

Ellison, the former co-chief executive of Bankman-Fried's crypto hedge fund Alameda Research, teared up describing the final days before the exchange declared bankruptcy in November 2022. Ellison said that while she felt "indescribably bad" about the harm caused to FTX customers and employees, the collapse lifted the "dread" hanging over her.

"I felt a sense of relief that I didn't have to lie anymore," she said through tears.

The courtroom deputy handed Ellison a box of tissues.

Prosecutors say Bankman-Fried plundered billions in customer funds to prop up Alameda, buy real estate and donate more than $100 million to U.S. political campaigns. FTX collapsed and declared bankruptcy in November 2022, shocking financial markets and destroying Bankman-Fried's reputation as a responsible operator in the cryptocurrency industry.

Earlier on Wednesday, Ellison testified that Bankman-Fried directed her to falsify Alameda's balance sheets to keep lenders at bay amid a downturn in cryptocurrency markets in 2022. Balance sheets sent to crypto lenders including Genesis Global Capital concealed that Alameda had borrowed around $10 billion in FTX customer funds, she said.

The 28-year-old Stanford University graduate said Bankman-Fried, her former boss and sometime romantic partner, also instructed her to draw from the fund's line of credit on the FTX cryptocurrency exchange to repay loans in June 2022.

She is one of three former members of Bankman-Fried's inner circle who have pleaded guilty to fraud charges and agreed to cooperate with the Manhattan U.S. Attorney's office.

Bankman-Fried has pleaded not guilty to two counts of fraud and five counts of conspiracy and has argued that while he made mistakes running FTX, he never intended to steal funds.

In his opening statement last week, defense lawyer Mark Cohen told jurors to question whether cooperating witnesses like Ellison were putting a new, nefarious spin on old decisions by Bankman-Fried which they had originally agreed with.

'DON'T LIE'

Bankman-Fried did not subscribe to rules such as "don't lie" and "don't steal," Ellison testified earlier on Wednesday.

The FTX founder described himself as a "utilitarian" who thought the only rule that mattered was doing the greatest good for the greatest number of people, Ellison said.

"He didn't think rules like 'don't lie' or 'don't steal' fit into that framework," she said.

Being around that mindset made her more comfortable over time with taking actions at Bankman-Fried's direction that she knew were wrong, she said.

Bankman-Fried also sought to cultivate an image as a "smart, competent, somewhat eccentric founder" and viewed his low-effort appearance and hairstyle as "very valuable," she said.

SAUDI STAKE, BINANCE CRACKDOWN

As cryptocurrency prices plummeted and the value of Alameda's assets dropped, Ellison said her awareness that the funds used to repay loans were ultimately coming from FTX customers put her in a "constant state of dread."

"Every day I was worrying about the possibility of customer withdrawals at FTX," she said.

Ellison said she and Bankman-Fried brainstormed multiple ways to support his companies. She said he suggested selling a stake in FTX to Saudi Arabian Crown Prince Mohammed bin Salman, and boosting its market share by getting regulators to "crack down" on rival crypto exchange Binance.

Ellison said regulators had "promised" Bankman-Fried that a Binance crackdown was coming but did not elaborate. The U.S. Securities and Exchange Commission sued Binance and its founder Changpeng Zhao in June 2023, alleging that they commingled and diverted customer funds. Binance and Zhao have denied the allegations.

Gary Wang, FTX's former technology chief, testified that Bankman-Fried falsely tweeted that FTX was "fine" in November as the exchange faced surging demand for withdrawals. A third cooperating witness, former FTX engineering chief Nishad Singh, is also expected to testify at the trial, which could last up to six weeks.