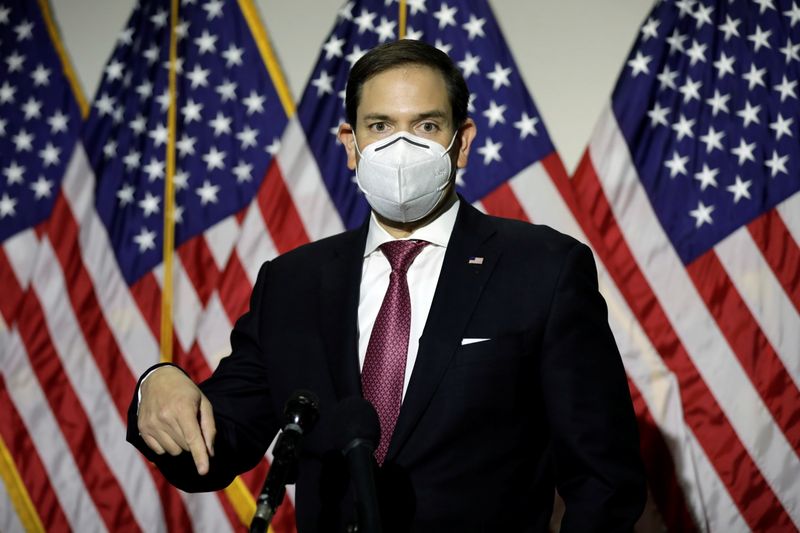

WASHINGTON (Reuters) - Top Republican Senator Marco Rubio has introduced legislation to block access to U.S. capital markets for Chinese companies that have been blacklisted by Washington, threatening a blow against Chinese firms that rely on U.S. investors for funding.

The bill, which Rubio submitted late on Monday, would bar U.S. investment firms, retirement funds, and insurance companies from taking stakes in Chinese companies that have been placed on a trade black list overseen by the Commerce Department or added to a list of firms backed by the Chinese military according to the Pentagon.

If the legislation is approved, blacklisted Chinese companies would also be banned from trading on U.S. exchanges after a year-long grace period.

"The Chinese Communist Party's exploitation of U.S. capital markets is a clear and ongoing risk to U.S. economic and national security that must be addressed," Rubio said in a statement to Reuters.

The legislation could hit surveillance camera maker Hangzhou Hikvision Digital Technology Co Ltd (SZ:002415), which was added to the trade blacklist for its involvement in China's suppression of its Uigher Muslim minority and placed on the DOD list in June. It could also hurt China Telecom (HK:0728) and China Mobile (HK:0941), which the Defense Department also labeled as backed by the Chinese military.

"It's a dark day for those on Wall Street who assumed that mainland-listed Chinese companies would continue to have unfettered access to the unregulated and unscreened 'back door' into U.S. capital markets via Exchange-traded funds (ETFs) benchmarked against indices," said Roger Robinson, a former White House official in the Ronald Reagan administration who has sought tougher controls on Chinese companies in U.S. capital markets.

The proposal comes amid growing pressure from Congress and the Trump administration to crack down on Chinese companies that enjoy the backing of U.S. investors but do not comply with U.S. rules faced by American rivals.

In August, U.S. Securities and Exchange Commission and Treasury officials urged President Donald Trump to delist Chinese companies that trade on U.S. exchanges and fail to meet its auditing requirements by January 2022.

The Senate unanimously passed legislation in May that could prevent some Chinese companies from listing their shares on U.S. exchanges unless they follow standards for U.S. audits and regulations.