By Abhirup Roy

SAN FRANCISCO (Reuters) -Rivian's earlier-than-expected bond issuance this month was aimed at strengthening the electric-vehicle maker's balance sheet before geopolitical risks make borrowing costlier and does not reflect concerns about its operations, its CEO said on Tuesday.

Following a $1.3-billion capital raise in March, Rivian (NASDAQ:RIVN) had said it had enough money to last it through 2025. But it said this month it would issue $1.5 billion, sparking concerns among investors and some suppliers about the company's financial health and sending shares plummeting.

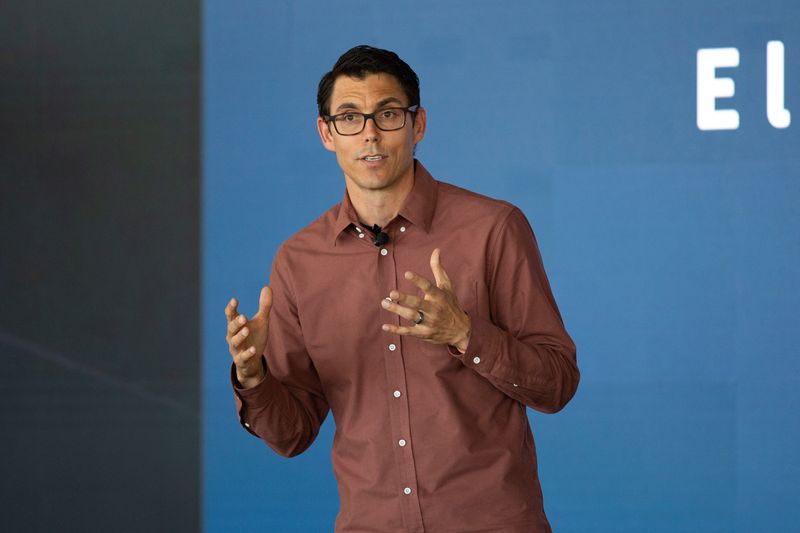

Seeking to allay those concerns, Rivian CEO RJ Scaringe told Reuters the new capital raise was meant to create an additional buffer as it was kicking off meaningful investments to build its smaller R2 vehicle family. The issue would also make sure "that we are never at risk of having a overly constrained or overly tight balance sheet," Scaringe said.

Rivian, which makes R1S sport utility vehicles and R1T pickup trucks, is set to unveil smaller and cheaper R2 cars. Their production is expected to begin in 2026.

"We don't control the macro economic environment, we cannot control political conflict, and those are real risks that exist not just specific to Rivian," Scaringe said.

"That's a risk to our capital markets and the liquidity of those capital markets."

The debt issuance comes as higher interest rates have jacked up borrowing costs. Recent robust economic data as well as uncertainties arising from the Israel-Hamas conflict suggest the U.S. central bank might leave interest rates higher for longer.

"I would not say this is any reflection of the degree of confidence we have for R2 both in terms of execution and in terms of our cost structure," Scaringe said.

Rivian has focused on boosting production to meet demand and doubled down on cutting costs to limit cash burn even as the industry grapples with a price war sparked by market leader Tesla (NASDAQ:TSLA) to stimulate softening demand.

The Irvine, California-based startup beat third-quarter delivery expectations this month as it produced more vehicles but disappointed investors by not raising its full-year target of 52,000 vehicles.

Scaringe declined to comment on the production target as the company is set to announce results early next month.

Rivian's cash balance as of Sept. 30 was estimated to be at $9.1 billion, down from $10.2 billion in June.