By Nate Raymond

(Reuters) -Seven Republican-led states filed a lawsuit on Tuesday to challenge President Joe Biden's administration's latest student debt forgiveness plan, saying the U.S. Department of Education was taking steps to start canceling loans as soon as this week.

The lawsuit came less than a week after the U.S. Supreme Court rejected the Biden administration's bid to revive a different student debt relief plan that was designed to lower monthly payments for millions of borrowers and speed up loan forgiveness for some.

In a lawsuit filed in federal court in Brunswick (NYSE:BC), Georgia, state attorneys general took aim at a rule the Education Department proposed in April that would provide for a waiver of federal student loan debts for an estimated 27.6 million borrowers.

Attorneys general from states including Georgia and Missouri say they recently obtained documents showing the Education Department has instructed federal loan servicers to begin canceling hundreds of billions of dollars of loans as early as either Tuesday or Saturday before the rule was finalized.

That could lead to the overnight cancellation of at least $73 billion in loans, the lawsuit said, and billions in further debt relief could follow. The states argue the Education Department has no authority to carry out such debt forgiveness.

"We successfully halted their first two illegal student loan cancellation schemes; I have no doubt we will secure yet another win to block the third one," Missouri Attorney General Andrew Bailey said in a statement.

An Education Department spokesperson declined to comment on the case but stressed it "will continue to fight for borrowers across the country who are struggling to repay their federal student loans." The department under Biden has already approved $169 billion in debt relief for nearly 4.8 million people.

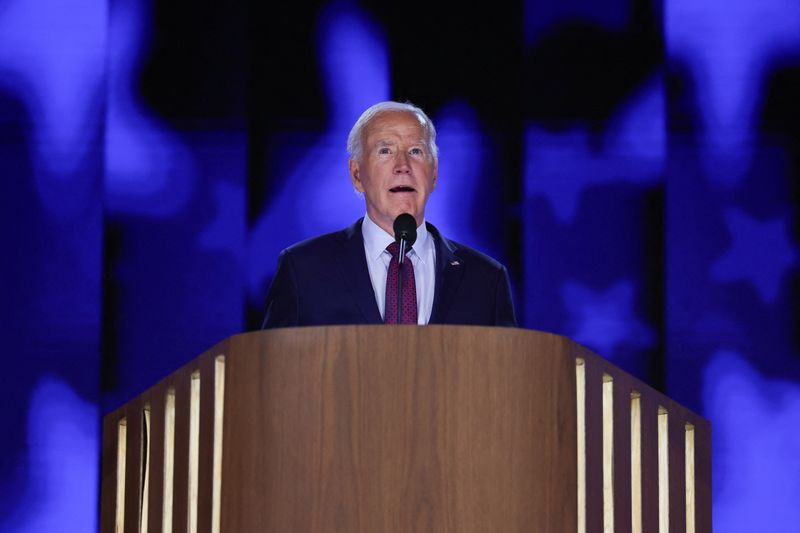

The lawsuit is the latest legal challenge to the Democratic president's efforts to fulfill a campaign pledge and bring debt relief to millions of Americans who turned to federal student loans to fund their costly higher education.

Republican-led states successfully convinced the 6-3 conservative majority U.S. Supreme Court in June 2023 to block a $430 billion program championed by Biden that would have canceled up to $20,000 in debt per borrower for up to 43 million Americans.

The administration then pursued a different program dubbed the Saving on a Valuable Education, or SAVE, plan, that was designed to lower monthly payments for millions of borrowers and speed up loan forgiveness for some.

But Republican-led states convinced a federal appeals court to block that plan while litigation over it continues to play out. The Supreme Court on Aug. 28 declined to lift that injunction.

The latest plan relies on a different statute than those, a provision of the Higher Education Act that several leading Democrats including U.S. Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren have long argued provides the administration authority to cancel student debt.