(Bloomberg) -- Australia’s central bank used its Statement on Monetary Policy to flesh out its consistent recent view of accelerating growth and sluggish inflation, suggesting interest rates will stay at a record-low 1.5 percent.

Main Takeaways

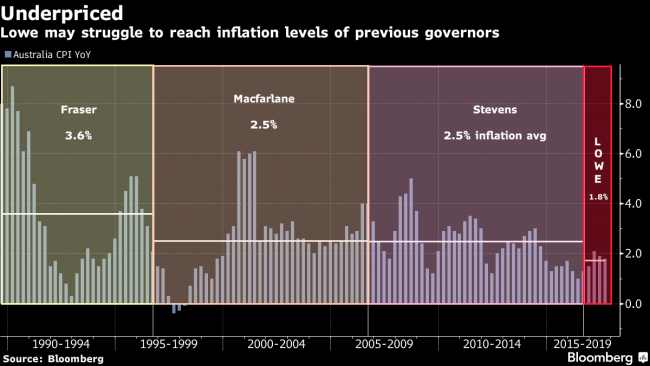

- Inflation held down by low wage growth, retail competition and spare capacity in labor market despite recent strong hiring; annual core inflation will only reach 2% in 2019

- Quarterly GDP growth to ease slightly in third quarter, then to average about 3% over next couple of years, led by resource exports and more positive business investment

- Household consumption likely slowed in third quarter after weak retail data; weak income growth and high debt levels are constraints

- Labor market conditions have “strengthened considerably” and forward indicators suggest “above-average employment growth” will continue.

- The RBA looked at the implications of CPI weights going out of date: “the bank estimates that substitution bias had reached around 0.4 percentage points for year-ended CPI inflation to the September quarter 2017.”

State of Play

The Reserve Bank of Australia has set the scene for a pickup in the economy while incorporating caveats seen in developed-world counterparts -- where tight labor markets have failed to drive up wages, yet they’re nonetheless starting to remove stimulus. A key concern is how Aussie households cope with record-high debt.

Westpac Banking Corp. CEO Brian Hartzer said in an analyst call Monday: “We don’t see the cash rate moving for some time.” Traders aren’t pricing in a really strong chance of a rate increase until November 2018.

Key Quotes

- “The experience of economies with tighter labor markets than Australia’s shows how long it can take for pricing pressures to emerge in an environment of strong local and global competition.”

- “Wage growth has been slow, averaging an annual rate of around 2 percent in recent quarters, but average earnings growth has been slower still. Shifts in the composition of employment within industries to lower-paid work might partly explain this.”

- “The outlook for business investment looks to be more positive than it has for some time” and “following recent data revisions non-mining business investment now appears to be increasing by more than previously thought.”

- “The stimulatory setting of monetary policy in Australia has supported the economy and helped generate a decline in unemployment. Over the period ahead, further progress on reducing spare capacity in the economy is expected, which in turn would support the forecast gradual increase in inflation.”

- Among key uncertainties, “the decision by Chinese authorities to implement substantial cuts to steel production for environmental reasons over the next few months increases the likelihood of near-term volatility in Chinese iron ore and coking coal demand.”

The Backdrop

The central bank is likely to keep its cash rate on hold for some time yet as it forecasts a strengthening labor market will eventually drive wage gains and faster inflation. Household spending remains a key uncertainty -- particularly after retail sales posted the weakest three-month stretch in seven years -- as policy makers fret that highly indebted households struggling with record-low wage growth will be spooked out of spending. Consumption accounts for more than half of gross domestic product.