By Arsheeya Bajwa

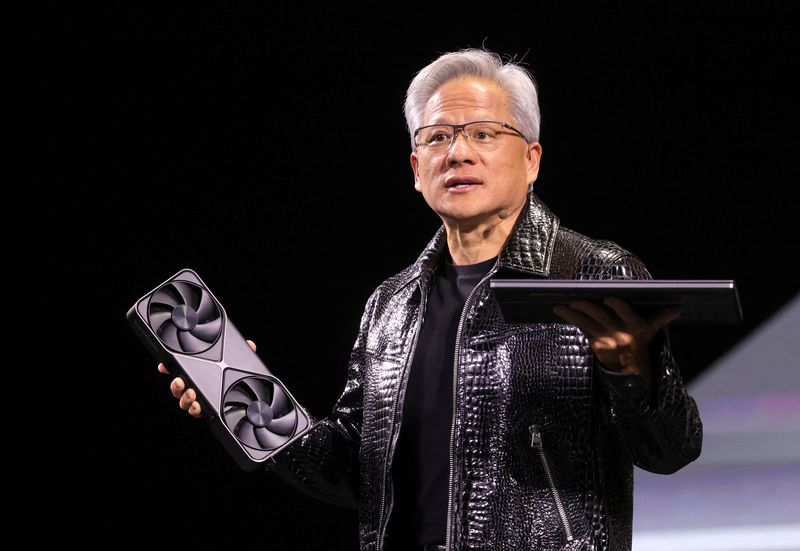

(Reuters) -Quantum computing stocks sank on Wednesday, pausing a year-long rally, after Nvidia (NASDAQ:NVDA) CEO Jensen Huang said the technology's practical use was likely two decades away.

The long wait outlined by Huang for "very useful quantum computers" throws cold water on a sector that was already expected to spend millions more on the technology, which can only perform niche calculations so far.

"If you kind of said 15 years... that'd probably be on the early side. If you said 30, it's probably on the late side. But if you picked 20, I think a whole bunch of us would believe it," he said on Tuesday.

Rigetti Computing, D-Wave Quantum (NASDAQ:QMCO), Quantum Computing and IonQ all fell more than 40%.

The companies, in total, were set to lose more than $8 billion in market value.

"The 15 to 20-year timeline seems very realistic," said Ivana Delevska, investment chief of Spear Invest, which holds Rigetti and IonQ shares in an actively managed ETF.

"That is roughly what it took Nvidia to develop accelerated computing."

The four quantum computing stocks rose at least threefold last year and outperformed a more than twofold rise in Nvidia shares, thanks to a high-profile breakthrough in the technology at Google (NASDAQ:GOOGL) in December.

The technology is seen as a key national security undertaking, with countries counting on it to drive decryption for military purposes.

Still, the revenue of these companies remains small.

IonQ, valued at more than $10 billion as of Tuesday, is expected to generate revenue of $41.6 million for fiscal 2024, according to data compiled by LSEG.

Rigetti, which had a market cap of about $4.4 billion based on Tuesday's close, is likely to bring in annual revenue of $11 million for 2024.

"There will be considerable government-related revenues in the next few years," Craig-Hallum analyst Richard Shannon said.

"If investors are worried about minimal revenues that will require dilution, they are missing a key part of the equation."

Quantum computing "will be disruptive to parts of the classical compute business, of which Nvidia is a chief beneficiary," Shannon said.