(Bloomberg Opinion) -- European bank capital is in better shape this year after a torrid last quarter of 2018, and the clearest illustration is from Italy’s biggest lender UniCredit SpA. It’s startling how much its cost of financing has improved.

The European Central Bank will hope this shows that its recently-announced bank stimulus measures might not be taken up on such a large scale as previously. If some of the most prolific users – Italian banks chief among them – of the ECB’s so-called “targeted longer-term refinancing operations” (known as TLTROs) are in better shape, then maybe it can start to wean the banking system off super-cheap funding.

UniCredit on Tuesday raised with ease 1 billion euros ($1.1 billion) of Additional Tier 1 hybrid bonds (deeply subordinated perpetual bonds with an issuer call after seven years) with a 7.5 percent yield. It was able to lower the coupon by 50 basis points from the initial price talk and still the order book was five times over-subscribed.

This is a world of difference from late November, when the bank sold $3 billion of notes in a private deal to Pimco. As I wrote at the time, that was a big win for the U.S. bond giant and a very expensive form of funding for UniCredit at a 7.83 percent coupon.

The two bonds are quite different – in currency, maturity and seniority. But both were required to fulfill UniCredit's regulatory funding requirements and each can be bailed-in (that is, the creditor takes a hit) in the event of the bank’s failure. Pimco’s senior dollar bonds would be the last to be affected, though, whereas the new AT1 hybrids would be first to be wiped out as equity capital.

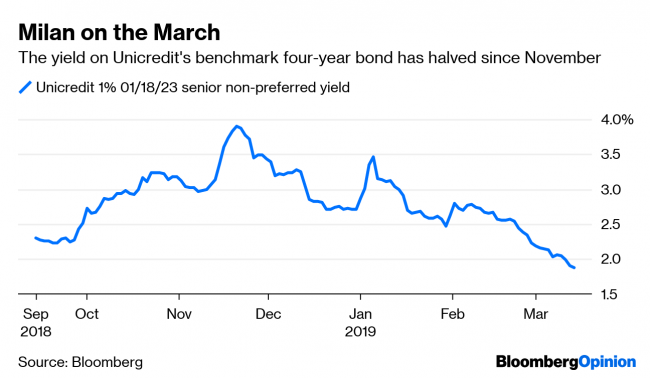

As a rough comparison, the 7.83 percent coupon on the private Pimco placement in November was equivalent at the time to about 5 percent in euros – about twice what UniCredit would have to pay now. The yield on its euro benchmark 2023 bond has halved since November to 2 percent and similarly the credit spread on its subordinated five-year credit default swap has fallen nearly 200 basis points

UniCredit is paying only 250 basis points more now to raise equity-equivalent regulatory capital (which is always much more expensive for the seller than more plain vanilla bonds) than it was for senior debt four months ago. In all likelihood, the bank wouldn’t have been able to raise equity capital late last year, as it probably would have had to offer a ruinous coupon of somewhere around 10 percent to attract investors.

This all shows that investors are much more comfortable now with the bank’s credit risk and Italy’s country risk. The resolution of the budget dispute between the populist coalition and the European Union is paying dividends for the funding costs of the sovereign, and the economic stability of the country. That’s something the ECB and the Brussels will need to weigh up if Italy’s budget demands reappear after May’s European Parliament elections.