By Jason Lange

WASHINGTON (Reuters) - America's lowest paid workers are getting bigger raises that are outpacing the gains of many of their better-off peers, a trend that suggests the benefits of U.S. economic growth are finally trickling down, boding well for the resilience of the upturn.

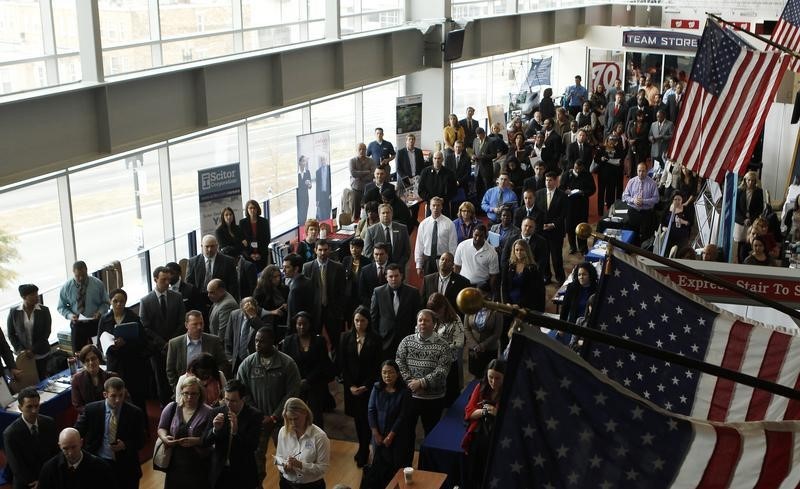

Employment data

The increases are still far from the levels needed to get back to the trend in earnings growth from before the 2007-9 recession.

Yet the firming of wages should give some reassurance to the Federal Reserve as it looks for signs of a broad-based economic recovery while it considers raising interest rates for the first time since 2006.

Wages in leisure and hospitality, the sector with the lowest average earnings at $14.23 an hour, rose 3.2 percent in the year through February, well above the private sector average which has remained nearly constant at 2 percent, according to a Reuters analysis of payroll data collected by the Labor Department.

Retail workers, who occupy the second rung from the bottom on the income ladder, are close behind with a 2.8 percent gain.

By comparison, annual wage increases in the leisure and hospitality sector averaged at just 1.3 percent in the five years after the recession's end in June 2009, the slowest pace for any sector tracked by the Labor Department.

The increases at the bottom come as earnings growth has cooled in high-income industries, such as finance, where wages grew 2.6 percent in the last year compared to 2.9 percent average annual growth in the five years the followed the recession.

Low-earners spend more of their income than those better off, who tend to save and invest more, so a bit more spring in the step of U.S. consumers could help the United States weather the chill settling over the global economy.

Low income households are also the main beneficiaries of a slide in gasoline and heating prices that has freed up more cash in family budgets for consumption.

"Getting this resiliency from the bottom is really important," said James Sweeney, chief economist at Credit Suisse (SIX:CSGN).

Retail, hospitality and leisure firms employ about 30 million workers, around a quarter of private employment. This group earned about $700 billion last year, roughly 15 percent of private sector wages.

Among full-time workers, the poorest 10 percent saw weekly earnings rise at a 2.6 percent annual rate over the last two years, Sweeney found in an analysis of a Labor Department survey of households, while richest 10 percent got a 0.7 percent increase. In the prior three years, earnings for the rich had grown more quickly than those of the poor.

Still, the cumulative gains since 2009 for the low-paying sectors remain much smaller than in high-tech industries and finance and it is too early to tell whether the emerging wage trend can have a meaningful impact on the wealth gap, economists say.

According to the Economic Policy Institute (EPI), a Washington-based liberal think tank, nominal wage rises of 3.5-4 percent per year will be needed before workers begin to recover losses from the last severe recession.

Still, there are signs that the labor market is tightening.

The number of job openings for every person looking for work is now about what it was in 2005, while workers are also quitting jobs more readily, even in low-income sectors, according to a third Labor Department survey. This puts pressure on firms to retain workers by offering higher wages.

Elise Gould, an economist at the EPI, said state-government mandated minimum wage hikes, rather than a scarcity of workers in retail, leisure and hospitality probably contributed to the improved fortunes of the bottom 10 percent.

"I would be surprised if those were the sectors where we saw the tightness first," she said.

Seventeen states and the District of Columbia raised minimum wages in 2014. Most of the increases were small, automatic adjustments for inflation, though a few larger hikes came through legislation, such as in California and Michigan.