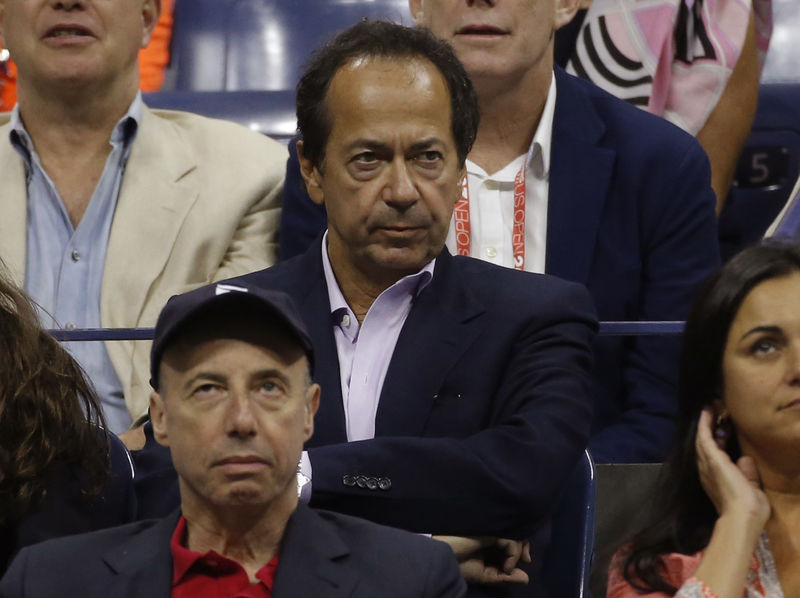

TORONTO (Reuters) - Long-time gold bull John Paulson followed through on Friday on a pledge made last year to team up with other gold investors in an effort to work with management of companies in the gold sector to improve returns, according to the group, called the Shareholders Gold Council.

The coalition, launched by Paulson's U.S. hedge fund Paulson & Co, will issue analyst reports and engage with management to improve capital allocation, compensation and corporate governance in gold companies, the coalition said in a statement.

The initial lineup includes a dozen named investors and four anonymous members.

The council includes Adrian Day Asset Management, Apogee Global Advisors, AMG Fondsverwaltung AG, Delbrook Capital, Equinox Partners LP, Equity Management Associates, John Hathaway, Kopernik Global Investors, Livermore Partners, La Mancha and Sun Valley Gold.

Reuters named a number of these investors in a report earlier this year.

The Shareholders Gold Council will be headed by Christian Godin, who was recently head of equities and director of research at Canadian fund manager Montrusco Bolton Investments Inc.

Paulson & Co called on the world's top investors in gold equities to form a coalition last September. Partner Marcelo Kim attacked the gold mining industry at the Denver Gold Forum, saying the sector needed to address high executive pay, cozy board appointments and value-destroying mergers and acquisitions.

Founded by the billionaire investor in 1994, Paulson & Co manages about $8.7 billion.