By Simon Jessop and Huw Jones

LONDON (Reuters) - The past year was the busiest ever for climate and sustainability rulemaking, with no let up expected in 2023 as policymakers tighten the net around flaky or fraudulent corporate behaviour.

From Canada to South Africa, the proposed or implemented rules covered everything from driving transparency in corporate supply chains to defining what an environmentally friendly activity even looks like.

Among the most prolific rulemakers was the European Union, which began to roll out sustainability rules for asset managers as part of a series of dictates aimed at ensuring the bloc hits its climate targets and helps rein in global warming.

Regulatory scrutiny also broadened to include investment ratings and the labeling of sustainable investment funds.

WHY IT MATTERS

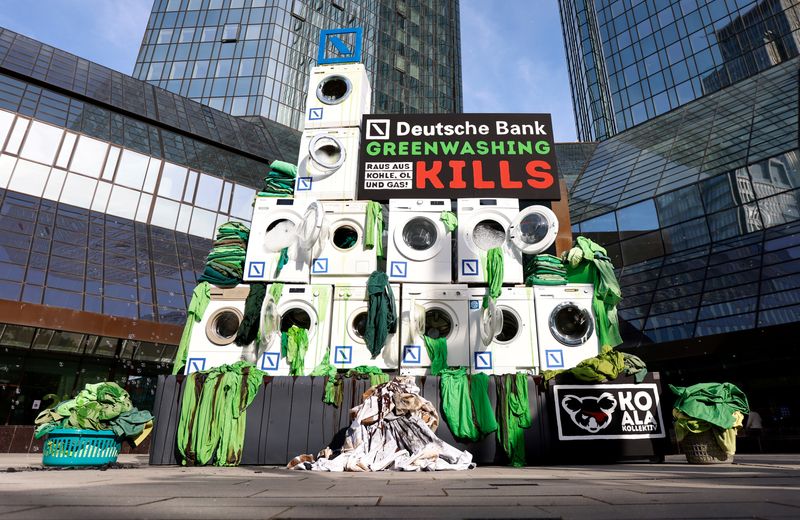

Increased regulatory worries about 'greenwashing', or inflated climate-friendly claims, come as trillions of dollars flow into companies and investments touting their environmental, social and governance (ESG) credentials.

With so much money being bet on companies doing well on ESG, and with a need to ensure laggards are held to account so the world can hit its climate and broader sustainability goals, regulators are making a push for clearer market guard rails.

Without them, it has traditionally been hard to punish bad practice, although 2022 saw that begin to change. In the United States, for example, both Goldman Sachs (NYSE:GS) Asset Management and BNY Mellon (NYSE:BK) Investment Adviser were fined over ESG failures.

German asset manager DWS meanwhile, saw its offices raided and its chief executive step down after allegations that it misled investors about its ESG investments.

With tougher rules, companies and financial firms will be forced to adopt higher standards and be more transparent over their ESG efforts, for fear of censure, be it public, regulatory or even legal.

Among companies to face legal or regulatory challenge over the last year were miner Glencore (OTC:GLNCY), the Dutch subsidiary of Air France KLM (OTC:AFLYY) and the directors of energy company Shell (LON:RDSa).

Question marks over a company's ESG credentials are also starting to draw the attention of activist investors, keen to leverage the wall of ESG money in the market to affect boardroom change.

WHAT DOES IT MEAN FOR 2023?

During 2022 the European Union, United States and the new, global International Sustainability Standards Board (ISSB) set out climate-related disclosure rules for companies to be finalised in 2023, meaning corporations can no longer hide behind an unregulated patchwork of voluntary norms.

ESG rules will also fast become mandatory rather than optional in 2023 - with the EU expected to push out 200 pages of guidance in January alone to help market participants use its green taxonomy, a list of environmentally friendly activities, and other ESG rules.

With so many rules popping up, a key task of regulators globally will be how they all sync together, making it easier for businesses to manage and ensuring bad practice in one area is not displaced to another.

The work of ISSB will also be key in pushing forward a global baseline for the climate-related information shared by companies with investors, making it easier to compare corporate efforts across the world.

However, this is only likely to happen in stages from 2023 given there are no global taxonomies or rules on what constitute sustainable investments.

Explore the Reuters round-up of news stories that dominated the year, and the outlook for 2023.