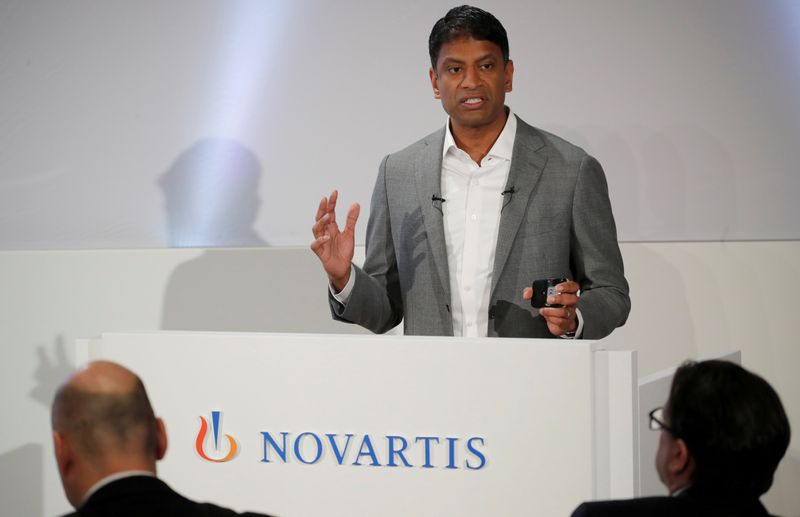

ZURICH (Reuters) - Swiss drugmaker Novartis AG has financial firepower for acquisitions even with net debt of $26 billion, though the COVID-19 pandemic has made it more difficult to value takeover candidates, Chief Executive Vas Narasimhan said in an interview.

"We generate a high free cash flow that allows us to not only finance our dividend but to direct capital to other purposes," Narasimhan told the Swiss newspaper Neue Zuercher Zeitung.

Still, "acquisitions have slowed recently from a structural perspective" during the pandemic, he said.

Narasimhan, a U.S. citizen who took over two years ago as CEO, acknowledged disappointment that Novartis' existing medicines had not proven more useful against COVID-19. For instance, the company, like others, abandoned a trial of its older malaria medicine hydroxychloroquine after it failed to help patients in scientific studies.

Moreover, he said Novartis had hoped to be faster in developing new drugs against COVID-19 and could have potentially profited from more cooperation with smaller biotech companies. "We concentrated more on our own in-house activities - and learned a lesson from it," he said.

Many of the medicines that Novartis is supplying for patients stricken with COVID-19 come from its Sandoz generics unit. For now, Narasimhan said Novartis is not interested in selling Sandoz, but rather continuing work to boost its sales and profit margins squeezed by U.S. price pressure.

"We believe at this time that we can do this best with Sandoz within the Novartis group," he told the newspaper.

Novartis' share price has fallen 15% this year, compared to peer Roche Holding AG (OTC:RHHVF)'s 2% rise.

Beyond recent legal settlements in corruption cases that topped $1 billion, Narasimhan believes safety problems that emerged with new eye medicine Beovu have cost Novartis shares 10% of their value.

"Challenge No. 1 was Beovu's launch," he said.