By Leika Kihara

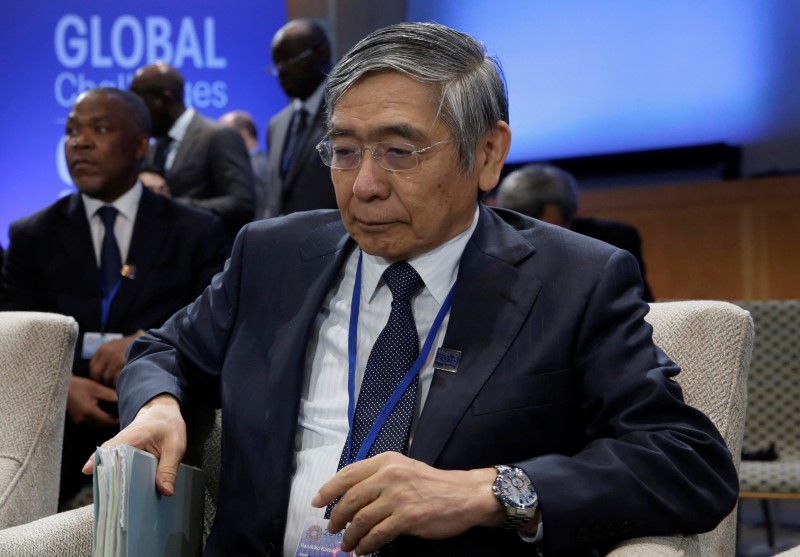

WASHINGTON (Reuters) - Bank of Japan Governor Haruhiko Kuroda on Thursday stressed the central bank's resolve to maintain its ultra-loose monetary policy, even as its U.S. and European counterparts begin to dial back their massive, crisis-mode monetary stimulus.

Kuroda offered an upbeat view of Japan's economy, saying it was expanding moderately with rising incomes leading to higher corporate and household spending.

But he said inflation and wage growth were disappointingly low, despite such improvements in the economy.

"Inflation remains around 0.5 percent, still below our target," Kuroda told reporters upon arrival for the Group of 20 finance leaders' gathering.

"I would like to explain to the G20 that we will continue our ultra-loose monetary policy to achieve 2 percent inflation at the earliest date possible," he said.

Kuroda deployed a massive asset-buying programme in 2013 in the hope of accelerating inflation to the BOJ's 2 percent target in a country mired in two decades of deflation.

But inflation remained subdued, forcing the BOJ to revamp its policy framework last year to one seen as more suited for a long-term battle to boost price growth.

Kuroda said subdued price and wage growth has become a common phenomenon in advanced economies including in Japan, where years of sliding prices have led the public to believe deflation will continue in the future.

But he voiced confidence that stronger economic growth, a narrowing output gap and a tightening labor market would eventually drive up inflation.

"It's only a question of time," he added.

The BOJ is widely expected to keep monetary settings unchanged at this month's rate review, even though it may cut yet again its inflation forecasts in a quarterly review of its long-term projections, due at the rate meeting.