(Bloomberg) -- Want to receive this post in your inbox? Sign up for Next China, a weekly email on where the nation stands and where it's headed.

Chinese President Xi Jinping has a busy 10 days ahead of him.

He’s in Pyongyang now, as you’re reading this newsletter, meeting with Kim Jong Un on how to defuse the stalemate with the U.S. over North Korea’s nuclear weapons program. Then at the end of the month, he’ll be sitting down with President Donald Trump in Japan to try and iron out their differences on trade.

And as distinct as each of these two issues may appear, they were long ago melded into one by Trump.

Help America rein in North Korea, Trump told Xi in 2017, and Beijing will get a more favorable trade deal. It’ll also stop the U.S. from labeling China a currency manipulator.

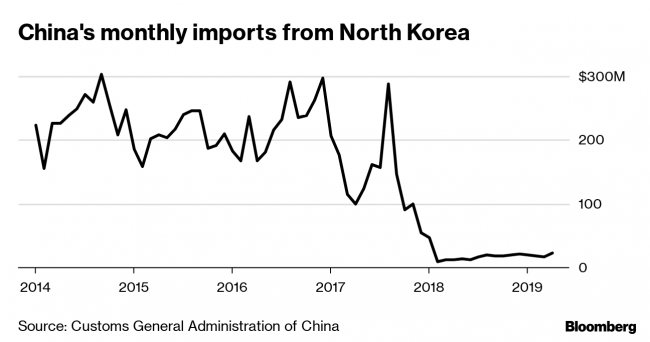

Beijing’s sway over Pyongyang is substantial, and its decision to support sanctions against Kim’s regime has had a painful impact on North Korea’s economy. How much Trump’s petitions have affected Chinese decision-making is far harder to gauge.

Finding a peaceful solution to the decades-long conundrum on the Korean peninsula would be a considerable achievement and one Trump would undoubtedly burnish. He’s already boosted of being nominated for a Nobel Peace Prize for his diplomatic efforts.

It may well be Xi’s ability to foster a détente between Pyongyang and Washington that becomes the pivot on which the trade war turns.

Prolonged Conflict

And of course that could all be wrong. If the trajectory of the trade war continues to escalate, Giant Manufacturing will be one of the companies that saw it coming first. The world’s largest maker of bicycles began moving production out of China last September when Chairwoman Bonnie Tu says she realized the “Made in China” era had come to an end. Meanwhile, Bank of America Merrill Lynch (NYSE:BAC) also warned investors this week not to ignore the possibility of a protracted trade war. The bank’s analysts’ see tighter Chinese capital controls and threats to Hong Kong’s role as a financial center being among the potential fallout.

Hong Kong

Trade isn’t all Hong Kong is dealing with. The city’s chief executive Carrie Lam “paused” the controversial extradition bill that had prompted hundreds of thousands to protest. That's not stopped calls for Lam to resign. But so far, the spillover for business appears limited. Home sales have continued at brisk pace and the city’s exchange is preparing for Alibaba’s secondary listing, which could raise as much as $20 billion. That’d make it Hong Kong second-largest share sale ever.

Word Choice

Another hot topic of conversation for financial markets in Hong Kong and China was the ongoing controversy surrounding UBS economist Paul Donovan's use of the phrase "Chinese pig" in a note about pork prices and inflation. China Railway Construction Corp. this week excluded UBS from a bond sale after the comment set off a furor on Chinese social media. That was after the Swiss bank placed Donovan on leave and the Chinese Securities Association of Hong Kong called on UBS to fire those involved.

Rainbow Economy

Meanwhile, if you're looking for a place to get away for a while, consider Chengdu. The capital of Sichuan province, long famous for its spicy cuisine, is also becoming known for its acceptance of the LGBT community. Businesses are already paying attention, in Chengdu and more broadly in China. The country's so-called rainbow economy, worth about $300 billion a year, is creating new opportunities for companies such as Blued, a gay dating app that also helps couples who want children find overseas surrogates. It's also changing corporate behavior. Weibo, the popular microblogging site, last year reversed a decision to remove content with gay themes after it was bombarded with opposition.

Social Scoring

And finally, a look at China's plan to reward good behavior and punish bad through a social credit system. About a dozen local governments have so far rolled out trial versions, but not without problems. In Suzhou, for example, almost none of the residents are aware their city has a social credit system, or that they've already got scores. It's hard to affect behavior with social scores people don't know exist. Bickering between various government bureaucracies has been another issue. That of course doesn't mean the system won't become more effective with time, nor does it assuage concerns that it will be used to suppress dissent. But for now, the social credit system looks more like Kafka than Orwell.

To contact Bloomberg News staff for this story: John Liu in Beijing at jliu42@bloomberg.net

To contact the editor responsible for this story: Malcolm Scott at mscott23@bloomberg.net

©2019 Bloomberg L.P.