By Siddharth Cavale

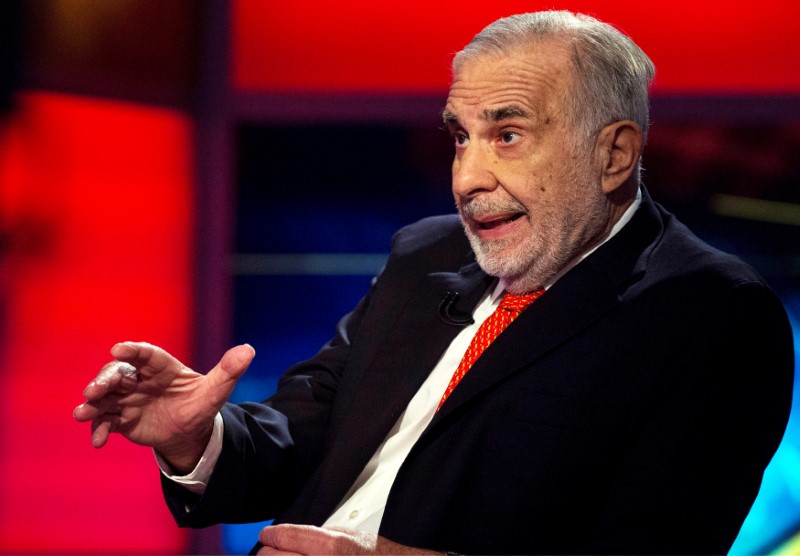

(Reuters) - Consumer products maker Newell Brands Inc (N:NWL) and hedge fund Starboard Value LP have agreed to end a months-long proxy fight through a deal brokered by fellow activist investor Carl Icahn that will add three new independent directors to the board.

Icahn, who has amassed a nearly 7 percent stake in the Sharpie maker, said on Monday he agreed to give up two of the four seats he secured last month to pave the way for the addition of two new independent directors, Gerardo Lopez and Robert Steele, to Newell's board.

In a combined statement, Newell and Icahn said they also planned to nominate Bridget Ryan Berman, a Starboard nominee, for election to the board at the company's 2018 annual meeting.

With the three additions, the board will expand to 12 from 11 now.

Wells Fargo (NYSE:WFC) analyst Bonnie Herzog said the end of the proxy battle with Starboard should remove an element of uncertainty.

"With a new board in place and a transformation plan underway, we see a good setup for Newell shares looking forward," she wrote in a note to clients.

Newell's shares rose as much as 2 percent in early trading as investors cheered the deal, just weeks ahead of the company's annual meeting, scheduled for the middle of May.

Starboard had signaled only a few weeks ago that it would push ahead with a proxy contest it started earlier this year, even after Icahn received board seats.

The settlement comes ahead of two separate key meetings that Starboard and the company were supposed to hold this week with proxy advisory firm Institutional Shareholder Services, which will now be canceled, according to people familiar with the matter.

Icahn said on Monday the decision to give up seats was to "facilitate peace" between Newell and Starboard's Jeff Smith, who runs the $8 billion hedge fund.

"The company reached out to us and requested that we give up two board seats to avoid a potentially disruptive proxy fight, which could have been especially bad at this important time for the company," Icahn said in the statement.

Starboard said it has agreed to withdraw its slate of directors and vote all of its shares in favor of the Newell nominees at the annual meeting.

"Nine of the twelve directors will be new to the board, and we are confident this newly reconstituted Board will bring a refreshed sense of urgency, oversight, and accountability to Newell," Starboard's Smith said.