By Liana B. Baker and Aishwarya Venugopal

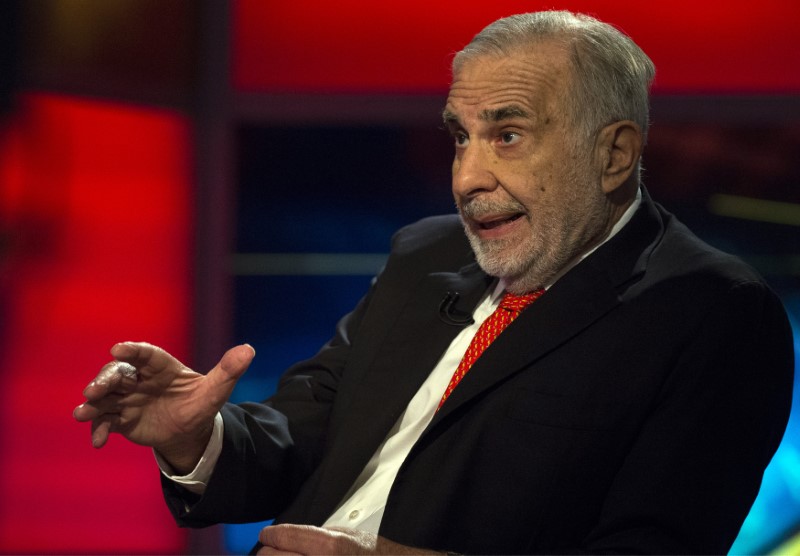

(Reuters) - Newell Brands Inc (N:NWL) said on Monday it has agreed to appoint four directors to its board put forward by billionaire investor Carl Icahn, a deal that excludes activist hedge fund Starboard Value LP, which had mounted its own board challenge.

The agreement is an example of activist investors competing against each other rather than working in tandem. Starboard, which is seeking to replace Newell's entire board of directors, declined to comment on its next move.

Icahn disclosed a 6.86 percent stake in the Hoboken, New Jersey-based consumer products company last Friday. However, he and Newell CEO Michael Polk have been in discussions since last month, according to two people familiar with the matter who requested anonymity to disclose the confidential talks.

One analyst said the Icahn board deal changes the dynamics of the contest. "But it doesn't mean that Starboard will capitulate," said Damien Park, managing director at consulting group Spotlight Advisors.

Newell's shares were down 6.5 percent $26.79 on Monday afternoon, giving the company a market capitalization of $13 billion.

"There is likely also a belief that the activist who loses will sell shares, putting pressure on the stock," Renaissance Macro Research analyst April Scee said.

Newell said it had accepted Icahn's designated nominees Patrick Campbell, Brett Icahn, Andrew Langham and Courtney Mather to sit on its board alongside existing directors Polk, James Craigie, Debra Crew, Steven Strobel and Michael Todman.

In addition, Judith Sprieser and another independent director nominee designated by Icahn and approved by Newell's board will be nominated to stand for election at the company's 2018 annual shareholder meeting.

Starboard has put forward a 12-member slate to replace Newell’s board, arguing the maker of Rubbermaid, Crock-Pot slow cookers and Yankee Candles has underperformed peers and mismanaged its $15.4 billion acquisition of Jarden Corp in 2016.

Starboard had teamed up with former Jarden executives and board members including former chairman Martin Franklin, who resigned from Newell's board earlier this year.

Icahn said in a statement that his views on strategy are aligned with those of the company, including on its "expanded transformation plan" that includes divesting some business lines.

Late last month, Newell outlined ongoing plans to overhaul itself from a hybrid holding-and-operating company to a more focused operator, with an increased emphasis on higher-margin operations such as online sales.

Icahn had said in a regulatory filing last week that he had spoken to Starboard but that he had not yet decided which side he will back.