(Bloomberg) -- The surge in emerging-market stocks this year is putting the asset class within spitting distance of finally catching up with the rally in developing-nation currencies.

The relative performance of MSCI Inc.’s indexes since the beginning of 2007, before the global financial crisis, shows equities are trailing currencies by only five percentage points, compared with as much as 30 points in the beginning of 2016. While both stocks and currencies are set for their best year since 2009, the gain in equities has been more than three times larger.

“Emerging-market stocks are more responsive to the global growth pickup than currencies, which are more tied to concerns of rising interest rates in the U.S.,” said Rodrigo Borges, the Sao Paulo-based head of fixed income at Franklin Templeton’s Brazil investment unit.

Stocks outperformed currencies by more than 20 percentage points in 2007 before plunging six times more in the following year amid the financial crisis. Equities trimmed the cumulative underperformance relative to currencies between 2009 and 2010, but the gap widened in 2015 before beginning to narrow at the start of 2016.

The MSCI Emerging Markets Index of stocks has gained 23 percent since the end of 2006, compared with 28 percent for the the MSCI Emerging Market Currency Index. The picture is different when including dividends: Stocks have returned 64 percent in that period.

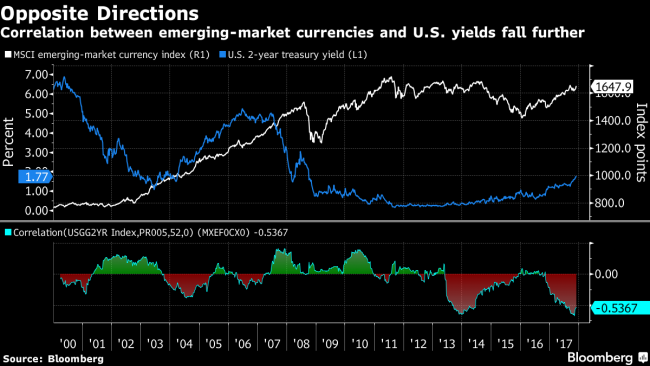

Concern that rising U.S. interest rates could diminish investor appetite for higher-yielding assets have increased the negative correlation between emerging-market currencies and Treasury yields -- when one goes up, the other usually goes down. The ties between the two reached a record of -0.67 percent in early November. The links between Treasury yields and emerging-market stock prices are a lot looser, with their correlation ratio at -0.16 percent.