By Dhirendra Tripathi

Investing.com -- Stocks fell on Wednesday as Wall Street absorbed mixed data on the U.S. economic recovery, including worse than expected progress on jobs but improvement in services demand.

ADP’s private payrolls report showed employers added 330,000 jobs in July, far lower than the 695,000 expected. The government’s own nonfarm payrolls report is due out Friday.

The Institute for Supply Management reported its non-manufacturing activity index hit 64.1 last month from 60.1 in June, the highest reading in its history.

Contributing to the market sentiment on Wednesday, Federal Reserve Vice Chair Richard Clarida commented that the economy is on track to meet the employment and inflation goals the Federal Reserve has set for raising interest rates.

But the news was also filled with concerning stories about the spread of the highly contagious Delta variant of coronavirus. Cases and hospitalizations are spiking, especially in areas of the South and California where vaccination rates have been relatively low.

In New York, the annual auto show was canceled for the second year, and organizers cited spiking cases of Covid. It was to have started August 20 at the Javits Center, a giant exhibition space that functioned as a vaccination megasite during the spring.

Earnings continue to roll out this week. Here are three things that could affect markets tomorrow:

1. Pharma earnings

Covid-19 vaccine maker Moderna Inc (NASDAQ:MRNA) is expected to announce second-quarter earnings per share of $5.96 on revenue of $4.21 billion. Listen for what they say about their plans for an mRNA vaccine for malaria.

2. Home decor earnings

Buying stuff for your home was a big pandemic activity, but that was all bound to end at some point. Home decor ecommerce site Wayfair Inc (NYSE:W) is seen posting revenue of $3.95 billion and EPS of $1.17 for the second quarter, according to analysts tracked by Investing.com.

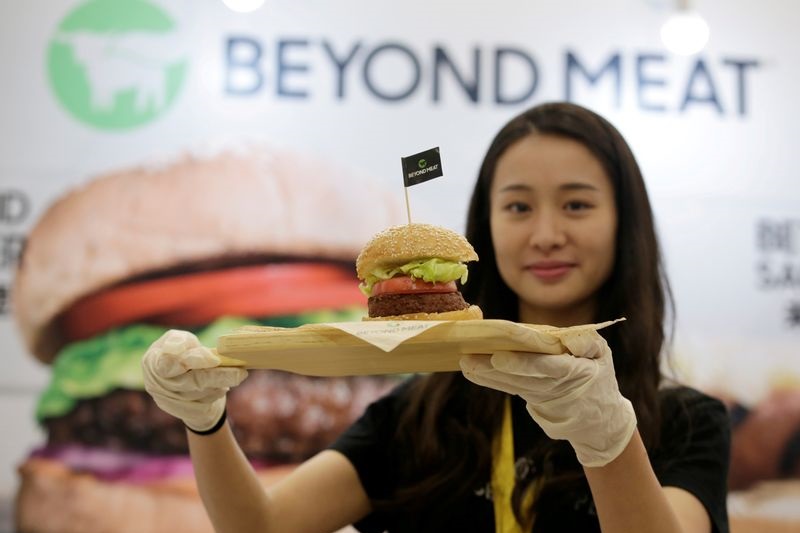

3. Fake meat results

Plant-based food maker Beyond Meat Inc (NASDAQ:BYND) is expected to post a loss of 22 cents per share and revenue of $141 million for the second quarter.